For the 24 hours to 23:00 GMT, the USD declined 0.18% against the CAD and closed at 1.3208 on Friday.

Data showed that Canada’s unemployment rate unexpectedly advanced to 5.7% in July, defying market expectations for an unchanged reading. In the preceding month, unemployment rate had registered a rate of 5.5%. Moreover, the nation’s building permits surprisingly dropped 3.7% on a monthly basis in June, defying market consensus for a gain of 1.0%. Building permits had registered a revised fall of 12.2% in the previous month. Also, the seasonally adjusted housing starts declined to a level of 222.0K in July, less than market expectations for a fall to a level of 202.0K. Housing starts had registered a revised reading of 245.5K in the prior month.

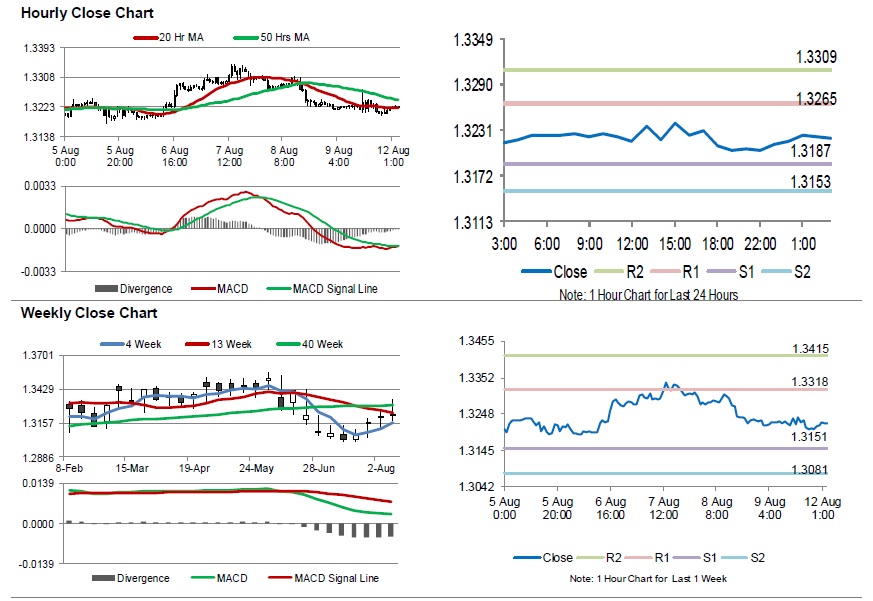

In the Asian session, at GMT0300, the pair is trading at 1.3221, with the USD trading 0.10% higher against the CAD from Friday’s close.

The pair is expected to find support at 1.3187, and a fall through could take it to the next support level of 1.3153. The pair is expected to find its first resistance at 1.3265, and a rise through could take it to the next resistance level of 1.3309.

Amid lack of economic releases in Canada today, traders would focus on global macroeconomic events for further direction.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.