For the 24 hours to 23:00 GMT, the USD rose 0.82% against the CAD and closed at 1.3182.

The Canadian Dollar lost ground, after Canada’s building permits dropped more-than-estimated by 6.6% MoM in December, hitting its lowest level in almost a year, on weakness in both the residential and non-residential sectors. Market expectations was for the building permits to decline by 3.5%, following a revised fall of 1.2% in the prior month. Additionally, the nation’s seasonally adjusted Ivey–purchasing managers’ index (PMI) eased to a level of 57.2 in January, marking its weakest reading in five-months. In the previous month, the PMI had recorded a reading of 60.8. Further, the nation’s international merchandise trade surplus narrowed to a level of C$0.9 billion in December, compared to market expectations for the nation to post a surplus of C$0.2 billion. The nation had posted a revised surplus of C$1.0 billion in the previous month.

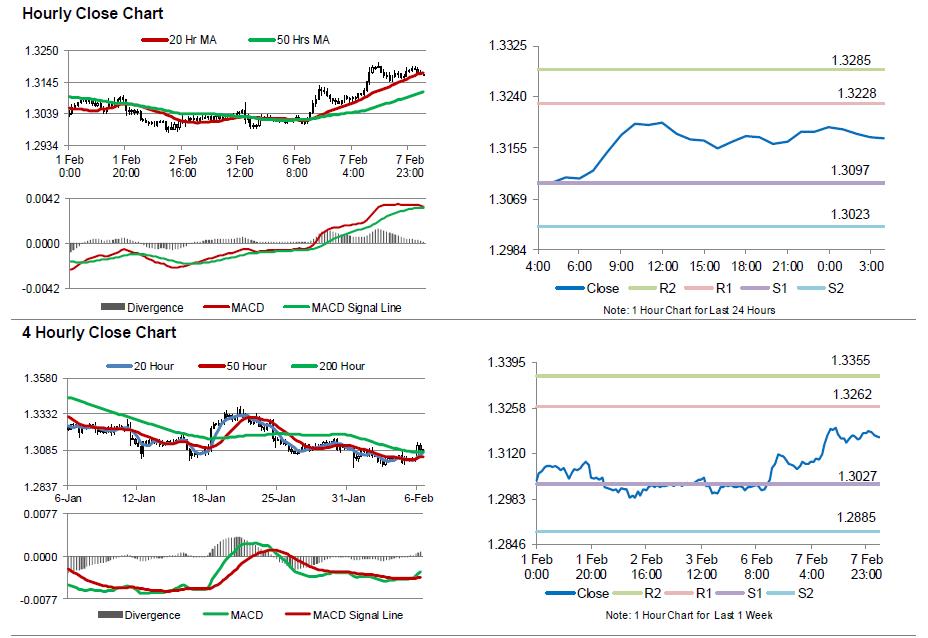

In the Asian session, at GMT0400, the pair is trading at 1.317, with the USD trading 0.09% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.3097, and a fall through could take it to the next support level of 1.3023. The pair is expected to find its first resistance at 1.3228, and a rise through could take it to the next resistance level of 1.3285.

Today investors will keep a close watch on Canada’s housing starts for January.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.