For the 24 hours to 23:00 GMT, USD declined 0.92% against the CAD to close at 0.9554, after higher-than-expected inflation figures sparked a rally in the Canadian dollar, reviving expectations that the Bank of Canada might resume raising rates again as early as July.

In Canada, the consumer price index, on an annual basis rose to 3.3% in March, compared to a figure of 2.2% recorded in the previous month. Meanwhile, the wholesale sales index declined by 0.6% (M-o-M) in February compared to the rise by 1.5% I the previous month. Additionally, index of leading indicators rose by 0.8% in March after 1.1% rise in February.

In the Asian session at 3:00GMT, the pair is trading at 0.9540, 0.15% lower from the New York session close.

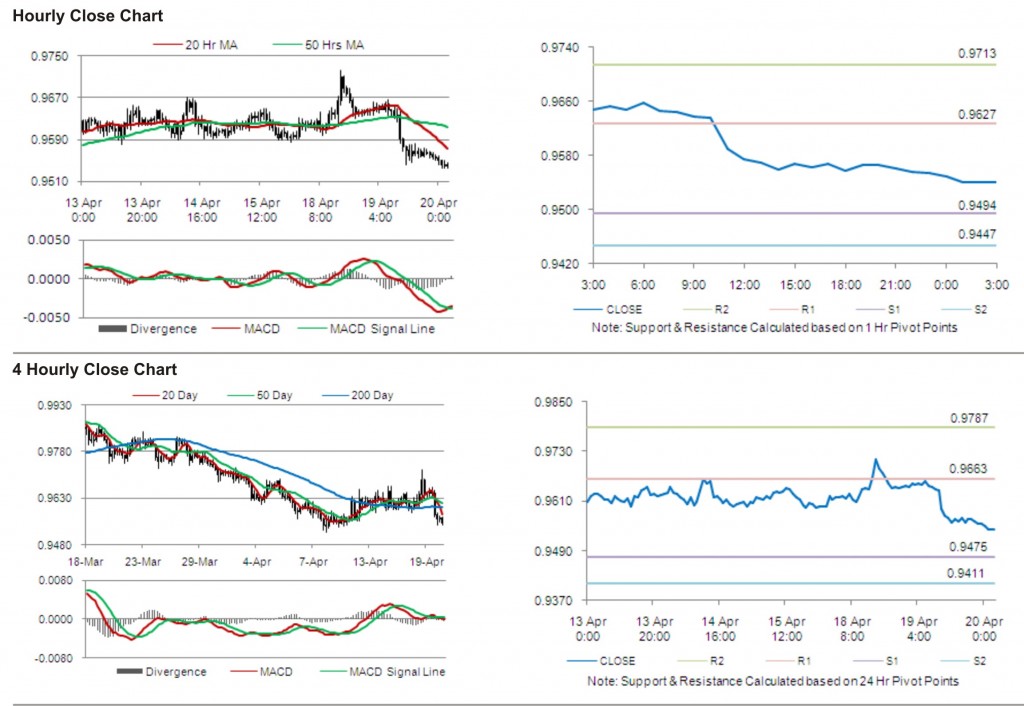

The first area of short term resistance is observed at 0.9627, followed by 0.9713 and 0.9846. The first area of support is at 0.9494, with the subsequent supports at 0.9447 and 0.9314.

The currency pair is trading just below its 20 Hr moving average and its 50 Hr moving average.