For the 24 hours to 23:00 GMT, USD declined marginally against the CAD to close at 1.0112.

Data released in Canada showed that the manufacturing sales climbed 2.0% in November to C$49.6 billion, the fourth increase in five months.

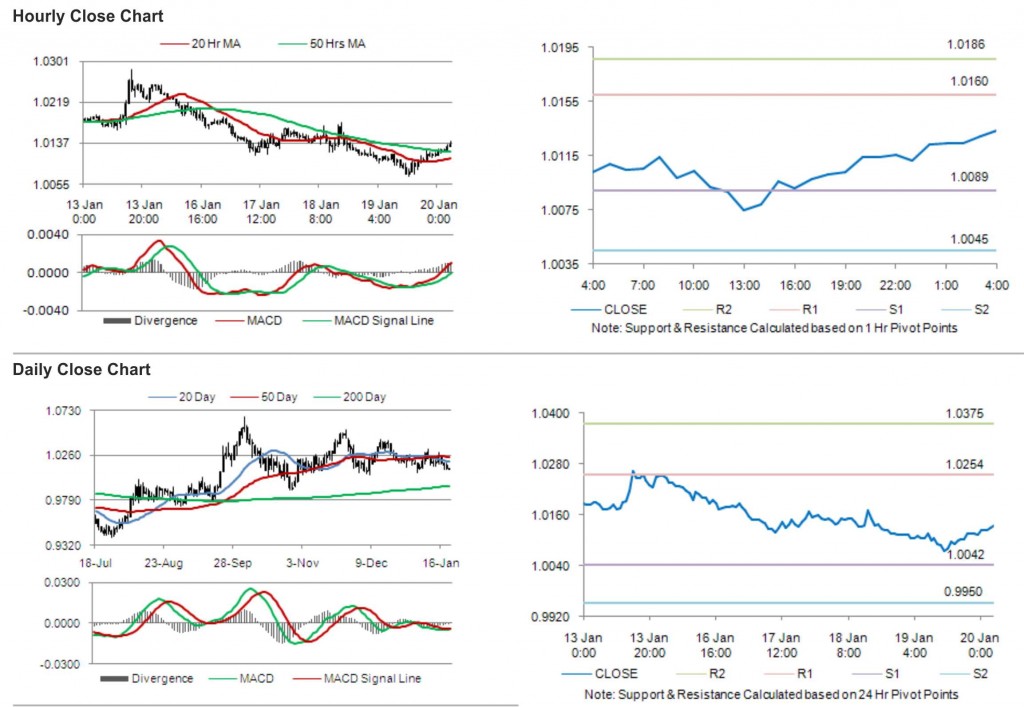

In the Asian session, at GMT0400, the pair is trading at 1.0133, with the USD trading 0.22% higher from yesterday’s close. The Canadian dollar slipped as a plunge in oil prices offset the impact of encouraging Canadian manufacturing data.

The pair is expected to find support at 1.0089, and a fall through could take it to the next support level of 1.0045. The pair is expected to find its first resistance at 1.0160, and a rise through could take it to the next resistance level of 1.0186.

Investors are awaiting economic releases of consumer prices and wholesale prices in Canada later today.

The currency pair is trading just above with its 20 Hr and its 50 Hr moving averages.