For the 24 hours to 23:00 GMT, USD declined 0.65% against the CAD to close at 0.9731.

Canadian dollar advanced amid surge in oil prices and as US trade deficit narrowed unexpectedly.

In the US, the trade deficit narrowed to $43.7 billion in April, following a downwardly revised trade deficit of $46.8 billion recorded in March.

In Canada, the new housing price index rose by 0.3% (M-o-M) in April, following no change in March. Meanwhile, trade deficit widened to C$0.92 billion in April, from C$0.42 billion in March.

In the Asian session at 3:00GMT, the pair is trading at 0.9735, 0.04% higher from yesterday’s close at 23:00 GMT.

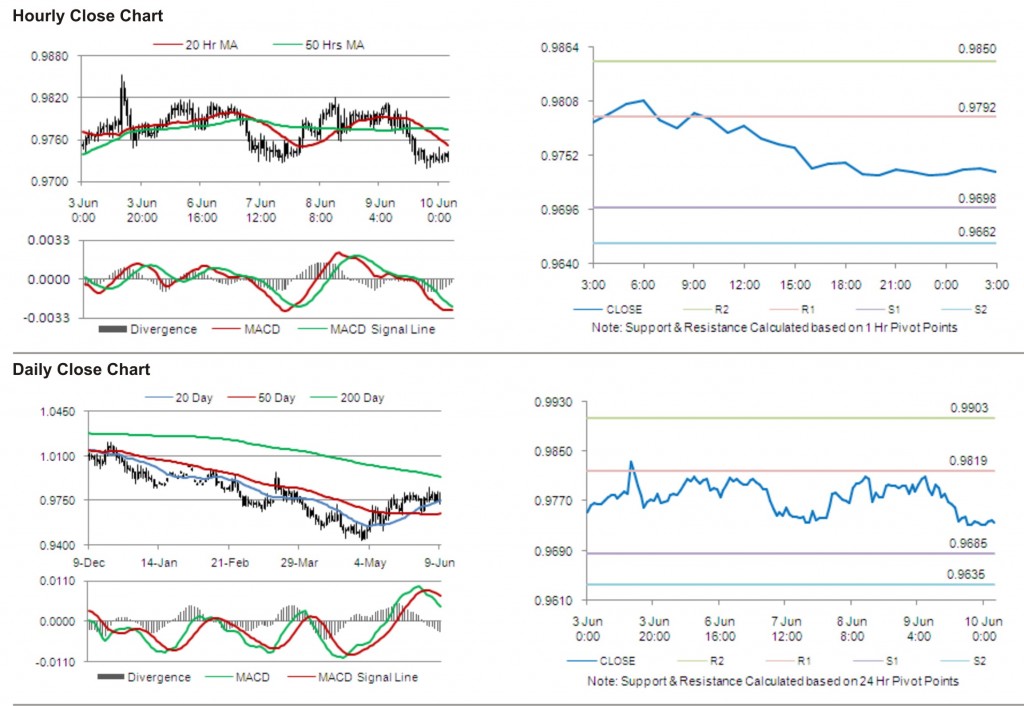

The first area of short term resistance is observed at 0.9792, followed by 0.9850 and 0.9944. The first area of support is at 0.9698, with the subsequent supports at 0.9662 and 0.9568.

Trading trends in the pair today are expected to be determined by data release of unemployment rate and labor productivity in Canada.

The currency pair is trading just below its 20 Hr and its 50 Hr moving averages.