For the 24 hours to 23:00 GMT, USD rose 0.93% against the CAD, on Friday, to close at 1.0478.

Canadian dollar declined against USD amid concerns that slowdown in global would lead to a decrease in exports and revenue of the country. A fall in commodity prices further added to the decline.

In the US, the Thomson Reuters/University of Michigan reported that the consumer sentiment index was revised upwards to a reading of 59.4 in September, compared to a reading of 57.8 reported earlier.

In Canada, the Gross Domestic Product (GDP) rose 0.3% (M-o-M) in July, compared to 0.2% rise in June.

In the Asian session at 3:00GMT, USD is trading at 1.0504, 0.25% higher against the Canadian dollar from Friday’s close at 23:00 GMT.

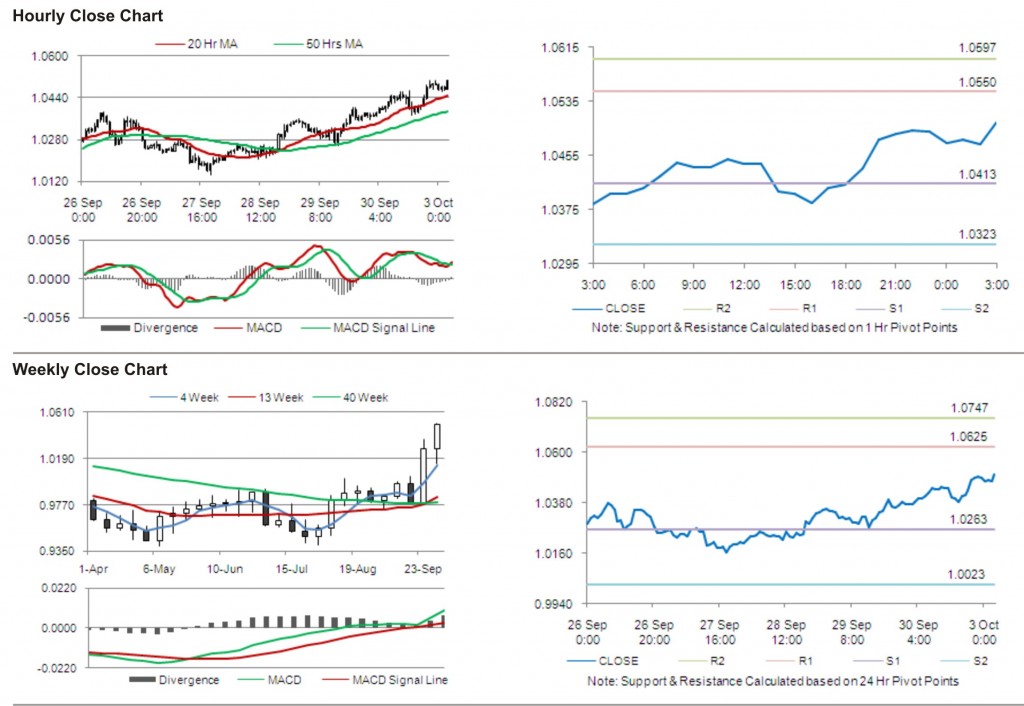

The first area of short term resistance is observed at 1.0550, followed by 1.0597 and 1.0734. The first area of support is at 1.0413, with the subsequent supports at 1.0323 and 1.0186.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.