For the 24 hours to 23:00 GMT, USD rose 0.40% against the CAD on Friday to close at 1.0152, amid speculation that the Bank of Canada would keep the benchmark lending rate at 1.0%, after a report showed that Canada’s annual inflation slowed more-than-expected in December.

In economic news, consumer price inflation in Canada eased to 2.3% (YoY) in December, following a rate of 2.9% recorded in November. Meanwhile, wholesale sales in Canada fell 0.4% (MoM) to C$49.0 billion in November after six straight monthly advances.

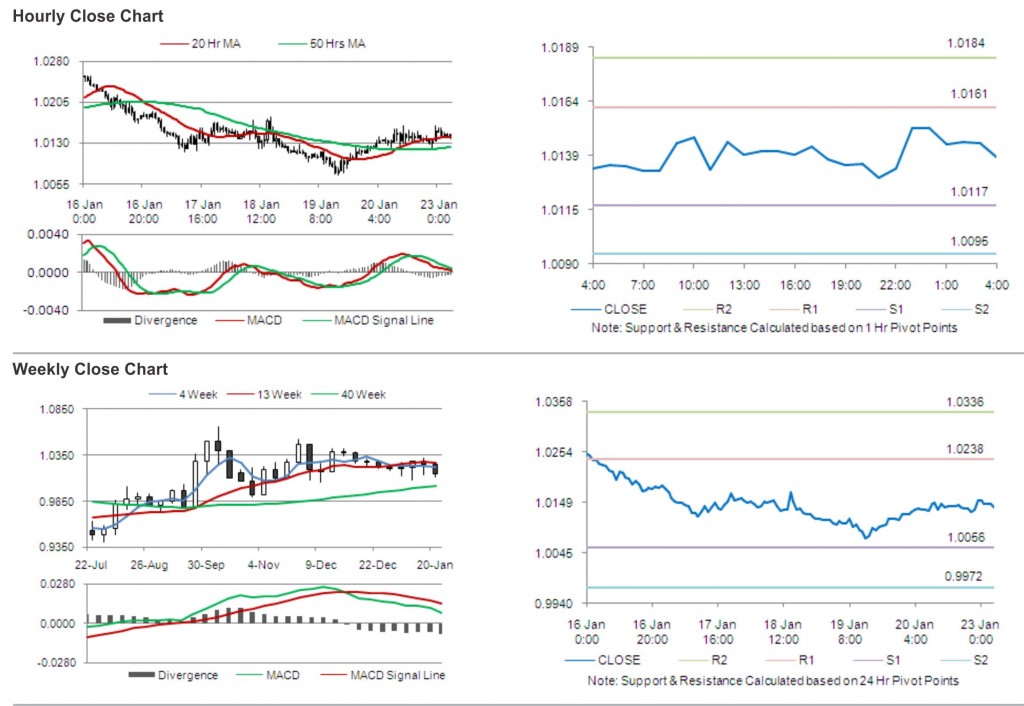

In the Asian session, at GMT0400, the pair is trading at 1.0139, with the USD trading 0.13% lower from Friday’s close.

The pair is expected to find support at 1.0117, and a fall through could take it to the next support level of 1.0095. The pair is expected to find its first resistance at 1.0161, and a rise through could take it to the next resistance level of 1.0184.

Trading trends in the pair today are expected to be determined by the release of leading indicator data in the day ahead.

The currency pair is converging with its 20 Hr and trading above its 50 Hr moving average.