For the 24 hours to 23:00 GMT, USD declined 0.24% against the CAD to close at 0.9882. Canadian dollar rose after retail sales in Canada increased 0.7% (M-o-M) in June, from 0.3% in May.

The Bank of Canada Deputy Governor, Jean Boivin, yesterday, stated that Canada’s central bank must take a “broad perspective” when setting monetary policy, taking all economic headwinds and tailwinds into account.

In the economic news, the Federal Reserve Bank of Richmond reported that its manufacturing index declined to a reading of -10.0 in August, following a reading of -1.0 posted in July. Additionally, on a seasonally adjusted basis, new home sales in the US declined 0.7% to an annual rate of 298,000 in July, compared to a revised rate of 300,000 recorded in June.

In the Asian session at 3:00GMT, the pair is trading at 0.9892, 0.10% higher from yesterday’s close at 23:00 GMT.

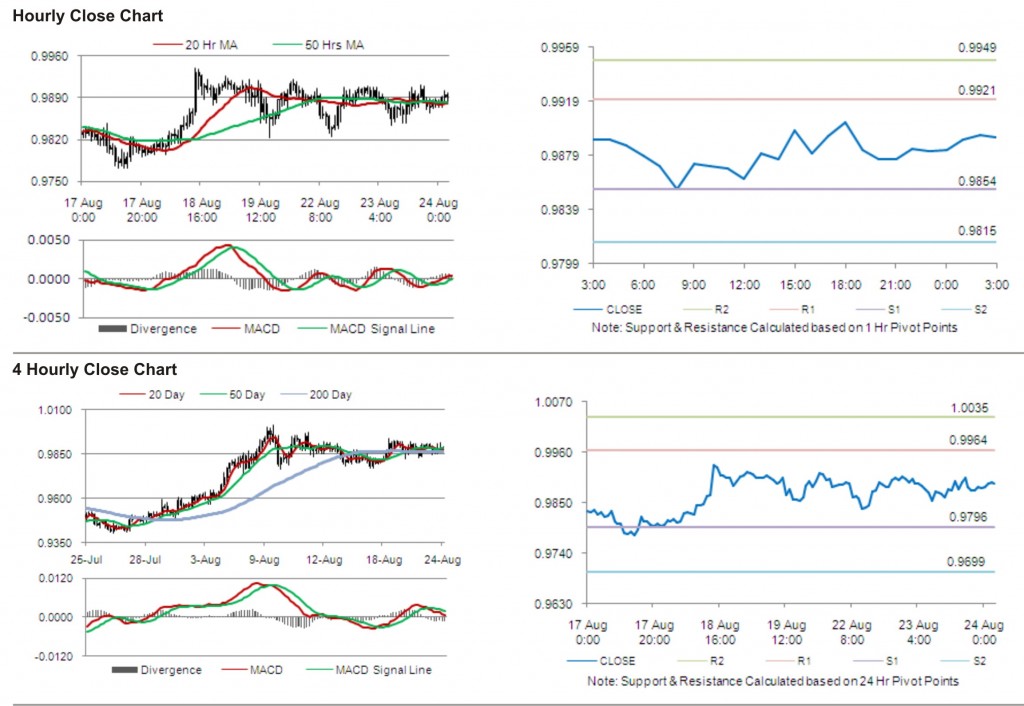

The first area of short term resistance is observed at 0.9921, followed by 0.9949 and 1.0016. The first area of support is at 0.9854, with the subsequent supports at 0.9815 and 0.9748.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.