For the 24 hours to 23:00 GMT, USD rose 0.67% against the CAD to close at 0.9999.

Canadian dollar declined against its US counterpart as concerns that European leaders would struggle to contain the debt crisis, diminished appeal for high-yielding assets.

In Canada, the Gross Domestic Product (GDP) rose 0.3% (M-o-M) in August, following a 0.4% rise in July. The Industrial Product Price Index (IPPI) increased 0.4% (M-o-M) in September, following 0.4% growth in August. Additionally, the Raw Material Price Index, on monthly basis, rose 1.4% in September, compared to 3.2% decline in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.0001, with the USD trading steady from yesterday’s close.

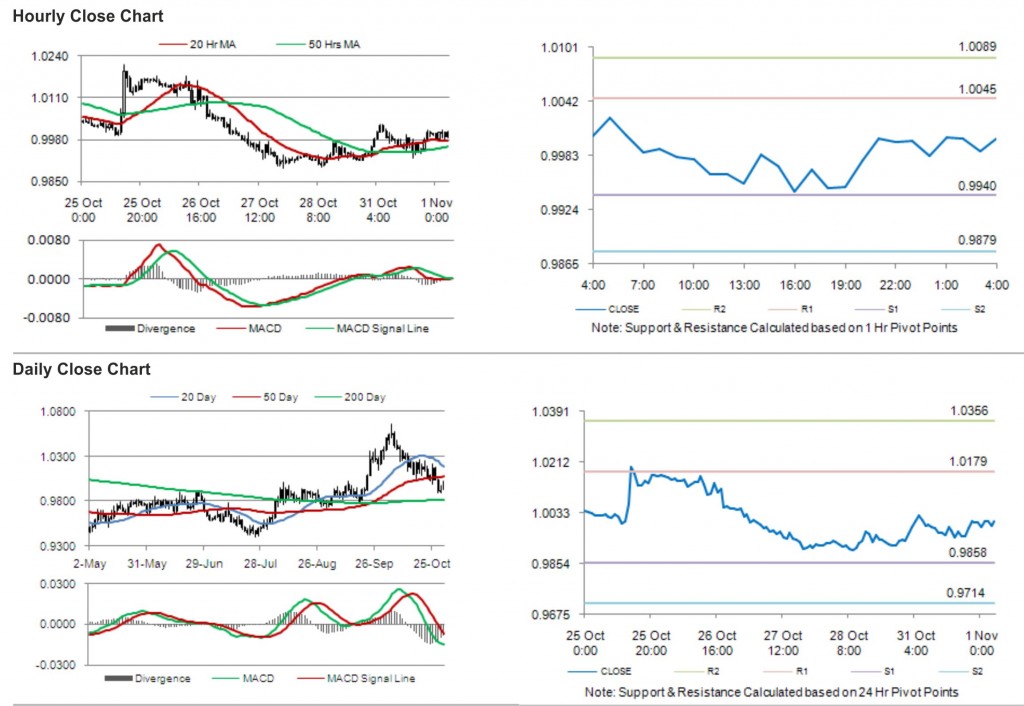

The pair is expected to find support at 0.9940, and a fall through could take it to the next support level of 0.9879. The pair is expected to find its first resistance at 1.0045, and a rise through could take it to the next resistance level of 1.0089.

The currency pair is trading just above its 20 Hr and 50 Hr moving averages.