For the 24 hours to 23:00 GMT, USD declined 0.09% against the CAD to close at 0.9778.

In the US, the Institute for Supply Management – Chicago reported that its business barometer fell to 56.5 in August, from 58.8 in July. Additionally, the Mortgage Bankers Association (MBA) reported that, mortgage application volume, on a seasonally adjusted basis, for the week ended 26 August 2011, edged down 9.6% from the prior week. Also, the refinancing demand for the week declined 12.2% from the previous week.

In Canada, on a sequential basis, the real Gross Domestic Product (GDP) fell 0.1% in the second quarter of 2011 (2Q FY2011), compared to a 0.9% rise in 1Q FY2011. Meanwhile, the Teranet-National Bank National Composite House Price Index climbed 1.7% (M-o-M) in June, the biggest monthly increase since August 2009.

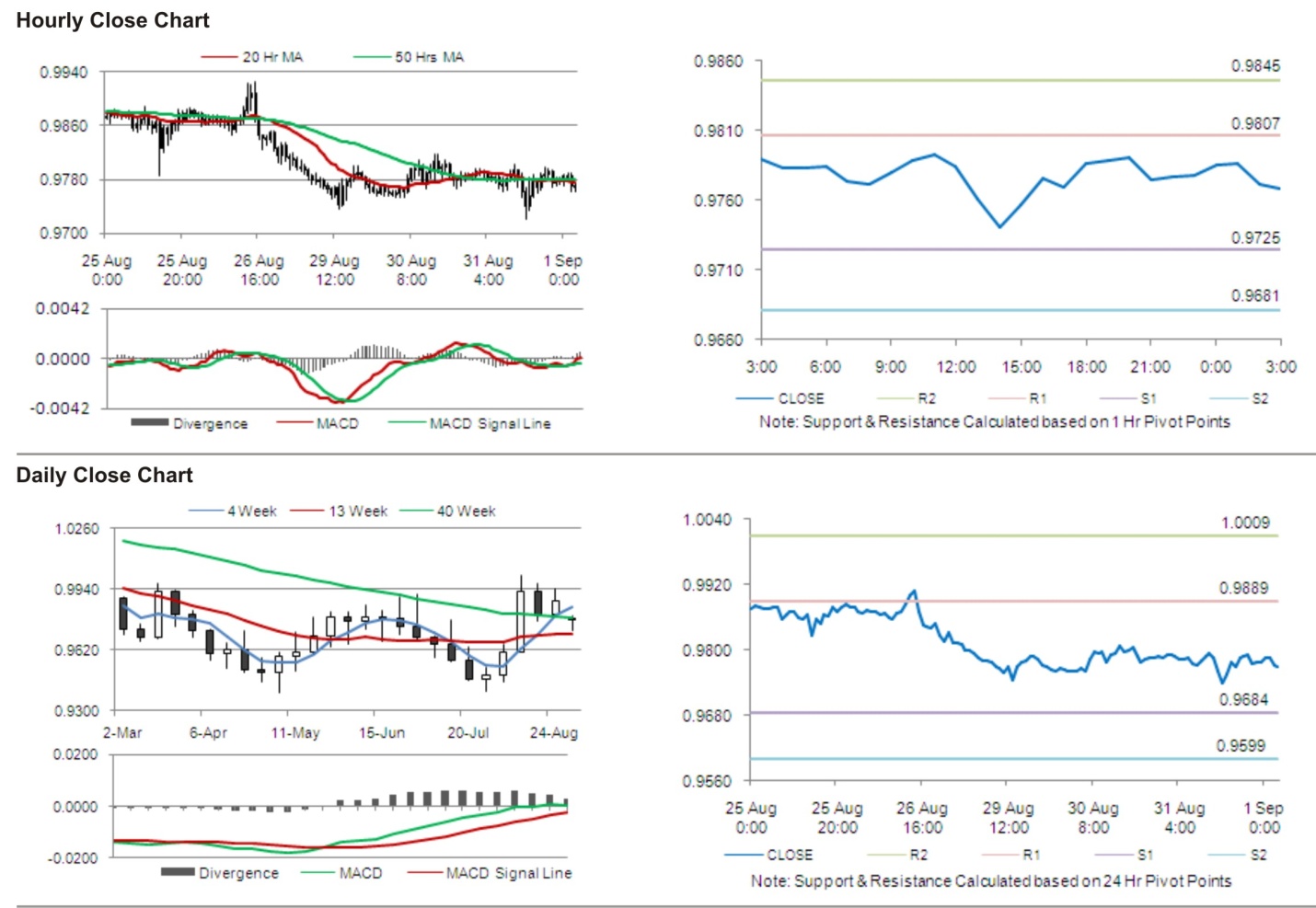

In the Asian session at 3:00GMT, the Canadian Dollar is trading at 0.9768, 0.10% higher against the greenback from yesterday’s close at 23:00 GMT.

The first area of short term resistance is observed at 0.9807, followed by 0.9845 and 0.9927. The first area of support is at 0.9725, with the subsequent supports at 0.9681 and 0.9599.

The currency pair is showing convergence with its 20 Hr and its 50 Hr moving averages.