For the 24 hours to 23:00 GMT, the USD rose 0.35% against the CAD and closed at 1.2478 on Friday.

The Canadian Dollar lost ground against the USD, after data showed that Canada’s gross domestic product (GDP) remained flat on a monthly basis in July, dragged by tumbling oil and automobile production and a slowdown in housing market. Market participants had envisaged the nation’s GDP to rise 0.1%, after recording an advance of 0.3% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.2490, with the USD trading 0.1% higher against the CAD from Friday’s close.

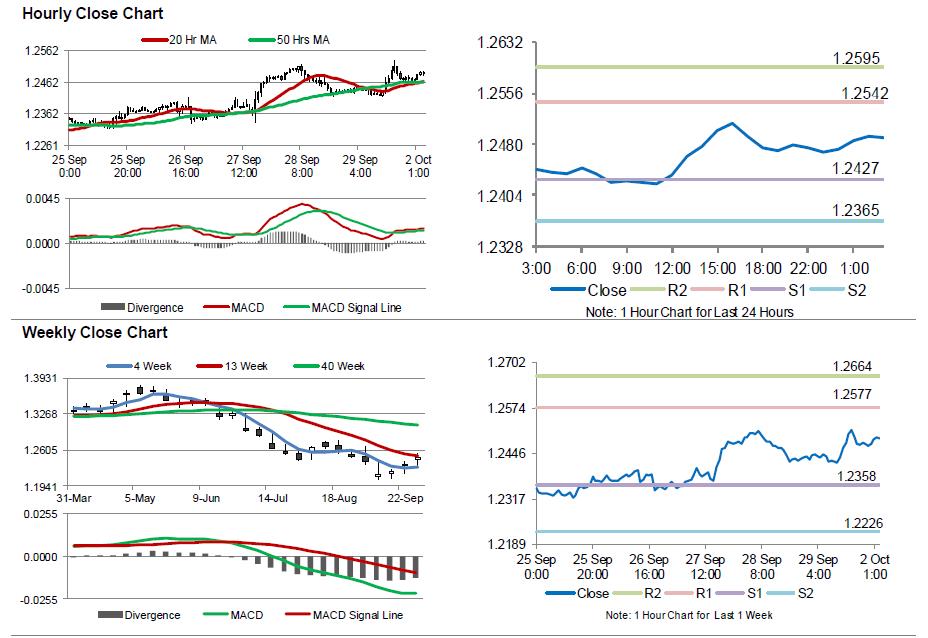

The pair is expected to find support at 1.2427, and a fall through could take it to the next support level of 1.2365. The pair is expected to find its first resistance at 1.2542, and a rise through could take it to the next resistance level of 1.2595.

Ahead in the day, investors would eye Canada’s Markit manufacturing PMI for September.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.