For the 24 hours to 23:00 GMT, the USD declined 1.13% against the CAD and closed at 1.2480.

The Canadian Dollar gained ground, after Canada’s gross domestic product (GDP) advanced 0.3% on a monthly basis in June, surpassing market expectations for an advance of 0.1% and boosting odds of another interest rate hike. In the prior month, the GDP had registered a rise of 0.60%. Meanwhile, the nation’s economy expanded at an annualised 4.5% in the second quarter of 2017, growing at its quickest pace in nearly six years, compared to an advance of 3.7% in the prior quarter.

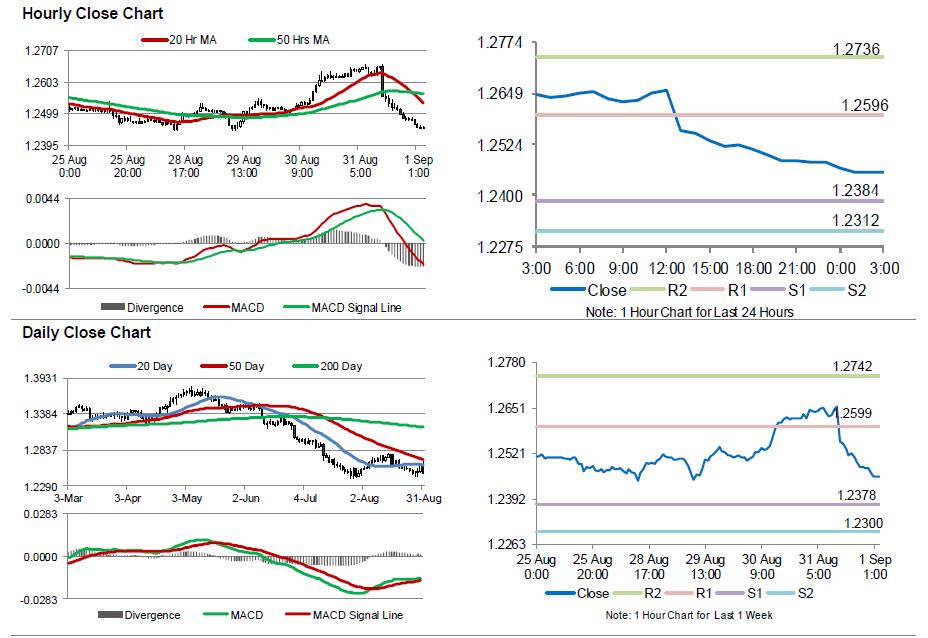

In the Asian session, at GMT0300, the pair is trading at 1.2457, with the USD trading 0.18% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.2384, and a fall through could take it to the next support level of 1.2312. The pair is expected to find its first resistance at 1.2596, and a rise through could take it to the next resistance level of 1.2736.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.