For the 24 hours to 23:00 GMT, the USD declined 0.54% against the CAD and closed at 1.3041.

The Canadian Dollar gained ground, after Canada’s gross domestic product (GDP) expanded more-than-expected by 0.4% on a monthly basis in November, driven by strength in the manufacturing sector. Markets expected for a rise of 0.3%, following a revised drop of 0.2% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.3084, with the USD trading 0.33% higher against the CAD from yesterday’s close.

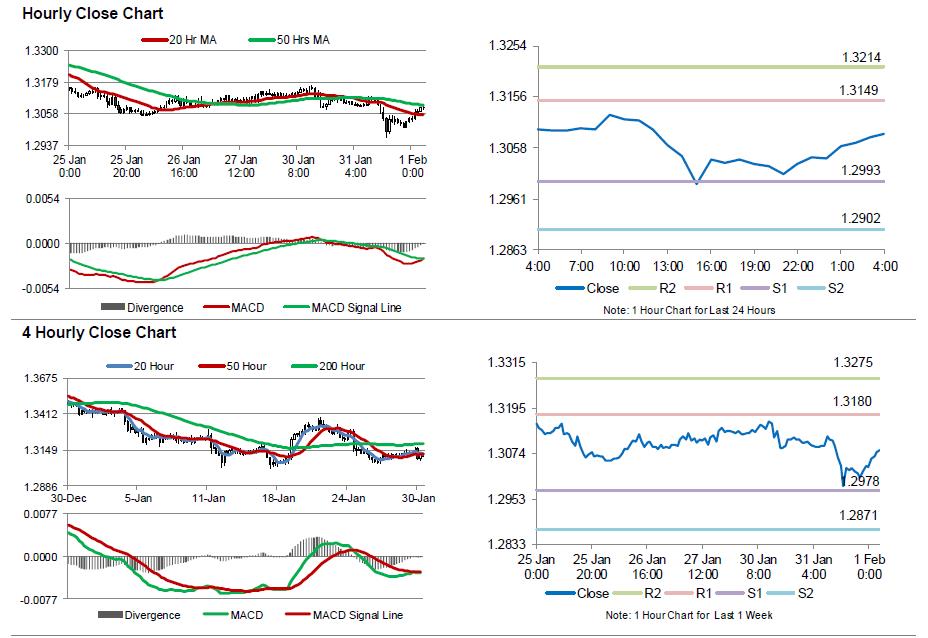

The pair is expected to find support at 1.2993, and a fall through could take it to the next support level of 1.2902. The pair is expected to find its first resistance at 1.3149, and a rise through could take it to the next resistance level of 1.3214.

Investors this afternoon will await Canada’s RBC manufacturing PMI for January.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.