For the 24 hours to 23:00 GMT, the USD rose 0.63% against the CAD to close at 1.2482.

The CAD lost ground, on the back of downbeat GDP figure in Canada.

Data released showed that Canada’s economy unexpectedly shrank 0.1% MoM, contracting for the fourth consecutive month in April and following a 0.2% fall recorded in the preceding month, as sliding oil prices continued to weigh on the nation’s economy. Market expectations were for a 0.1% expansion in April. The disappointing GDP growth data has reinforced the prospects of an interest rate cut by the BoC.

In the Asian session, at GMT0300, the pair is trading at 1.2491, with the USD trading 0.07% higher from yesterday’s close.

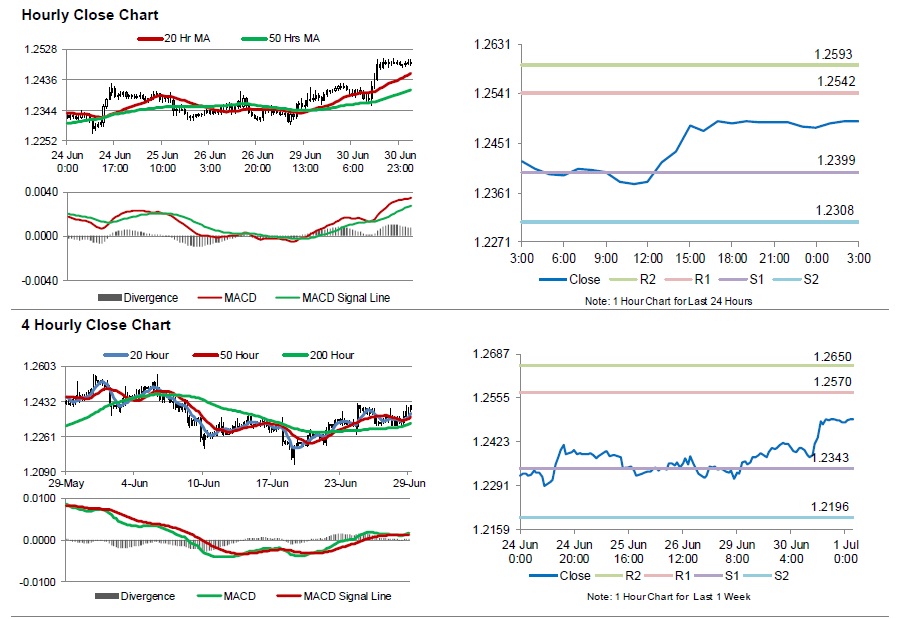

The pair is expected to find support at 1.2399, and a fall through could take it to the next support level of 1.2308. The pair is expected to find its first resistance at 1.2542, and a rise through could take it to the next resistance level of 1.2593.

On account of a holiday in Canadian markets today, investors would focus on tomorrow’s RBC manufacturing PMI data.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.