For the 24 hours to 23:00 GMT, the USD rose 0.13% against the CAD and closed at 1.3235.

Macroeconomic data showed that Canada’s seasonally adjusted housing starts rose more-than-anticipated to a level of 207.0K in December, indicating that housing sector continues to be one of the brightest spots in the economy. Housing starts recorded a revised reading of 187.3K in the prior month, while markets were expecting it to climb to a level of 190.0K. On the contrary, the nation’s building permits slid 0.1% on a monthly basis in November, less than market expectations for a drop of 6.0%. In the previous month, building permits had registered a revised rise of 10.5%.

In the Asian session, at GMT0400, the pair is trading at 1.3244, with the USD trading 0.07% higher against the CAD from yesterday’s close.

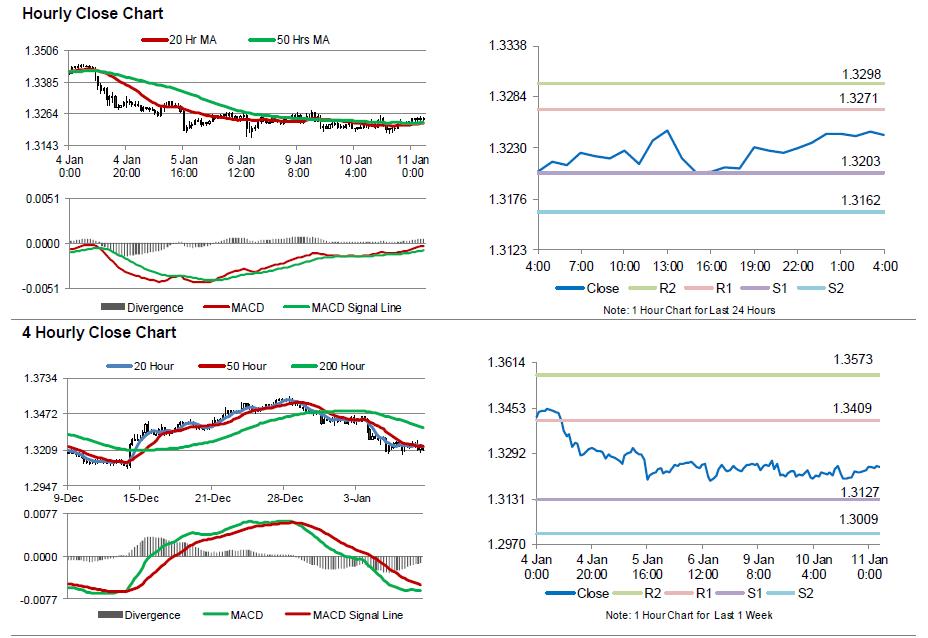

The pair is expected to find support at 1.3203, and a fall through could take it to the next support level of 1.3162. The pair is expected to find its first resistance at 1.3271, and a rise through could take it to the next resistance level of 1.3298.

Amid no economic releases in Canada today, trading trend in CAD is expected to be determined by global macroeconomic news.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.