For the 24 hours to 23:00 GMT, the USD rose 0.64% against the CAD and closed at 1.2652 on Friday.

Macroeconomic data indicated that Canada’s unemployment rate unexpectedly fell to 6.3% in July, hitting its lowest in nine years and defying market expectations for the unemployment rate to remain steady at 6.5%.

On the other hand, the nation’s seasonally adjusted Ivey PMI fell to a level of 60.0 in July, compared to a level of 61.6 in the prior month. Also, the nation’s international merchandise trade deficit surprisingly expanded to C$3.6 billion in June, compared to a revised deficit of C$1.36 billion registered in the prior month.

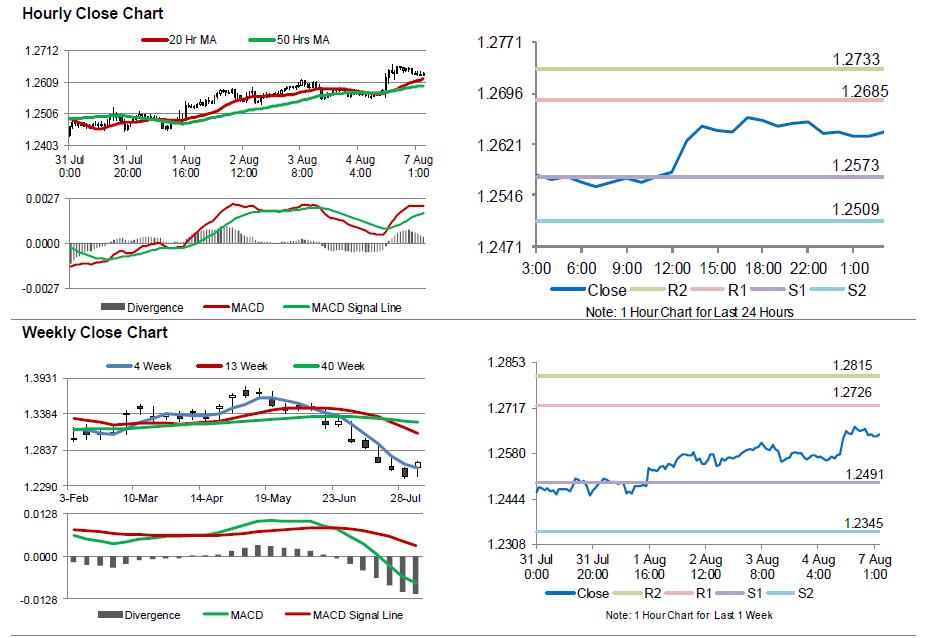

In the Asian session, at GMT0300, the pair is trading at 1.2638, with the USD trading 0.11% lower against the CAD from Friday’s close.

The pair is expected to find support at 1.2573, and a fall through could take it to the next support level of 1.2509. The pair is expected to find its first resistance at 1.2685, and a rise through could take it to the next resistance level of 1.2733.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.