For the 24 hours to 23:00 GMT, the USD declined 0.15% against the CAD to close at 1.0873.

In Canada, the Bank of Canada (BoC) Deputy Governor, Lawrence Schembri, indicated that, in order to push inflation upward to the central bank’s 2.0% target, interest rates in Canada are expected to be at a relatively low level for a prolonged period of time even as they pose a major challenge to the nation’s pension funds.

Separately, data showed that manufacturing shipments in Canada rose more-than-expected 0.4% (MoM), for the sixth time in seven months, to C$50.92 billion.

In the Asian session, at GMT0300, the pair is trading at 1.0873, with the USD trading flat from yesterday’s close.

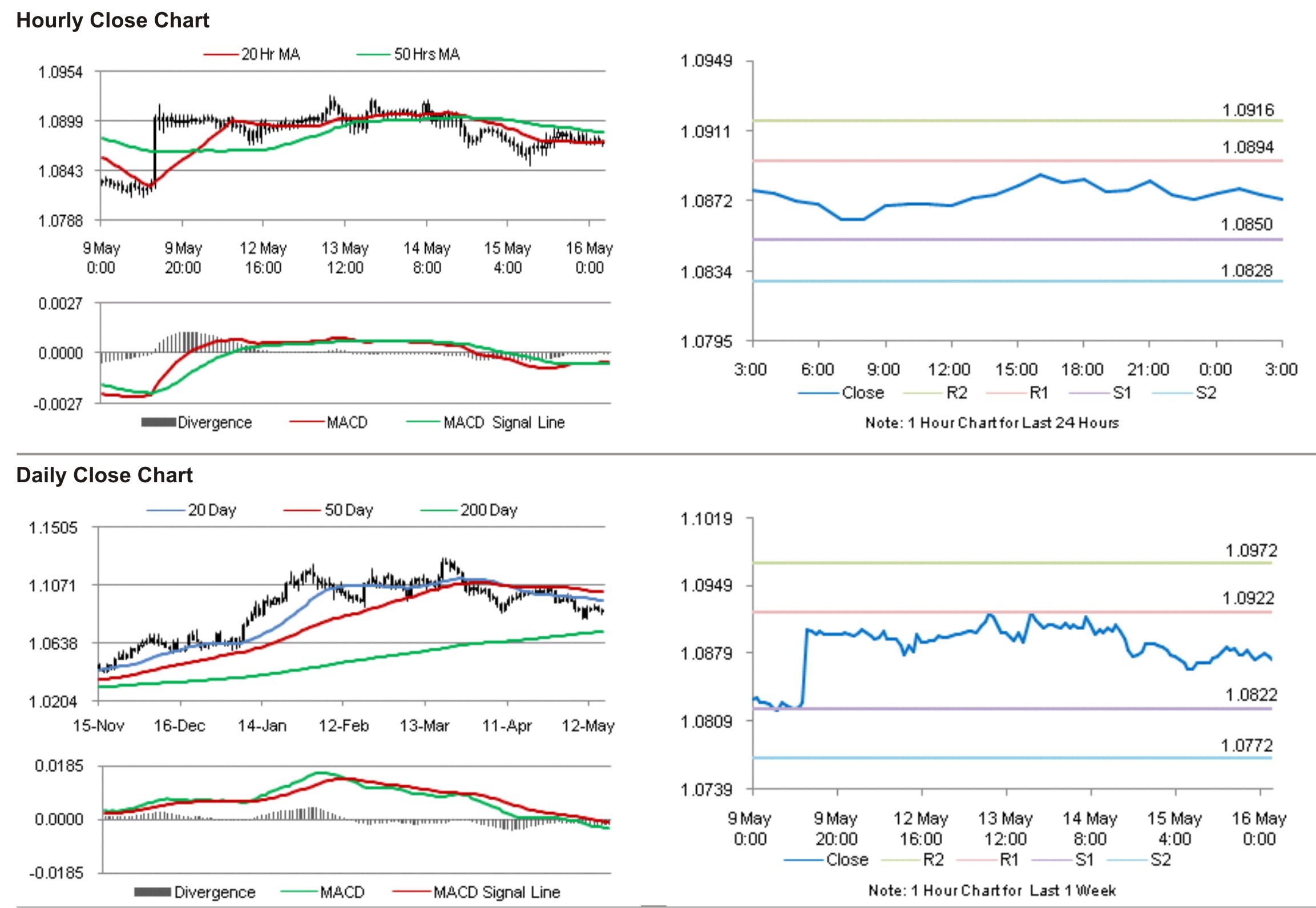

The pair is expected to find support at 1.0850, and a fall through could take it to the next support level of 1.0828. The pair is expected to find its first resistance at 1.0894, and a rise through could take it to the next resistance level of 1.0916.

During the later course of the day, the Statistics Canada is scheduled to publish data on the amount of foreign portfolio investment made in Canadian securities and the amount of Canadian portfolio investment done in foreign securities in the month of March.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.