For the 24 hours to 23:00 GMT, USD rose 0.17% against the CAD to close at 0.9828.

The Canadian dollar declined against the greenback as crude oil prices declined and European expansion slowed more than expected, raising concerns over a slowing world economy. Disappointing French-German summit also added to the growing global economic concerns.

In the economic news, the Canadian manufacturing sales decreased 1.5% (M-o-M) in June, from 0.7% drop in May.

In the Asian session at 3:00GMT, the pair is trading at 0.9824, marginally lower from yesterday’s close at 23:00 GMT.

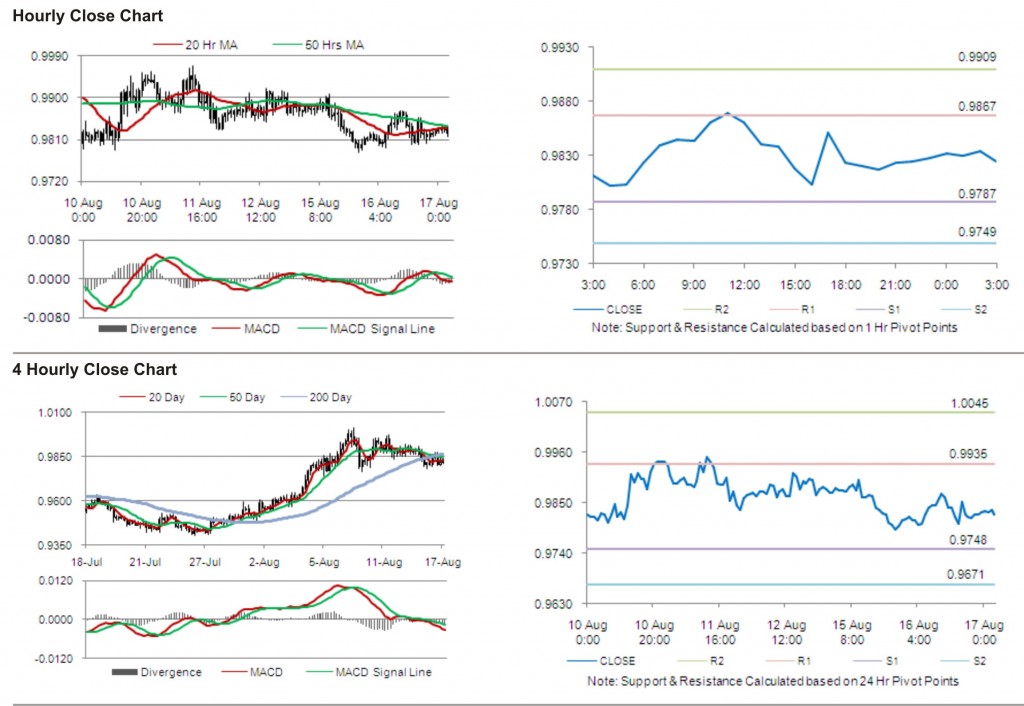

The first area of short term resistance is observed at 0.9867, followed by 0.9909 and 0.9989. The first area of support is at 0.9787, with the subsequent supports at 0.9749 and 0.9669.

Trading trends in the pair today are expected to be determined by release of data on foreign investment in Canadian securities.

The currency pair is trading just below with its 20 Hr and its 50 Hr moving averages.