For the 24 hours to 23:00 GMT, the USD rose 1.02% against the CAD to close at 1.3117.

Yesterday, the Bank of Canada, in a widely expected move kept its key overnight lending rate unchanged at 0.5%, following reductions made in January and July because of the effects of lower oil prices. The central bank in its latest monetary policy report indicated that the Canadian economy has been recovering, supported by its previous rate cuts and past depreciation of the Canadian Dollar. However, it downgraded Canada’s economic outlook again for the next two years, citing that the nation continues to struggle due to lower prices for oil and other commodities.

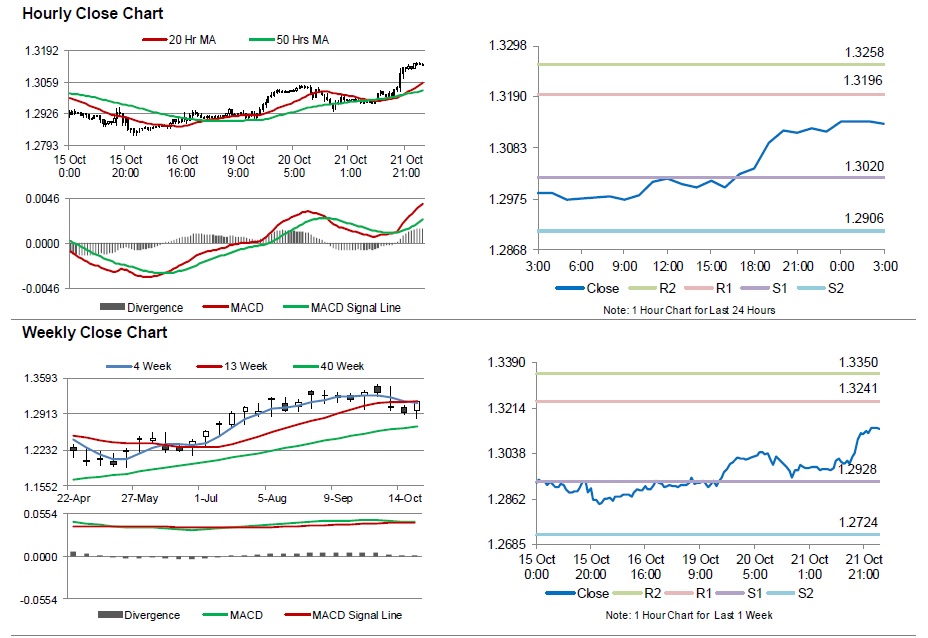

In the Asian session, at GMT0300, the pair is trading at 1.3133, with the USD trading 0.12% higher from yesterday’s close.

The pair is expected to find support at 1.3020, and a fall through could take it to the next support level of 1.2906. The pair is expected to find its first resistance at 1.3196, and a rise through could take it to the next resistance level of 1.3258.

Going ahead, investors will look forward to Canada’s retail sales data for August, scheduled to be released later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.