For the 24 hours to 23:00 GMT, the USD rose 0.51% against the CAD to close at 1.1376. The CAD came under pressure after Canada’s housing starts unexpectedly fell to a level of 183.6 K units in October, its lowest level in 7-months, lower than market expectations of a rise to a level of 200.00 K. It had registered a revised level of 197.40 K units in the prior month.

Yesterday, Canadian Finance Minister Joe Oliver cautioned that declining oil prices was adversely affecting the nation’s finances and economy.

In the Asian session, at GMT0400, the pair is trading at 1.1386, with the USD trading 0.09% higher from yesterday’s close.

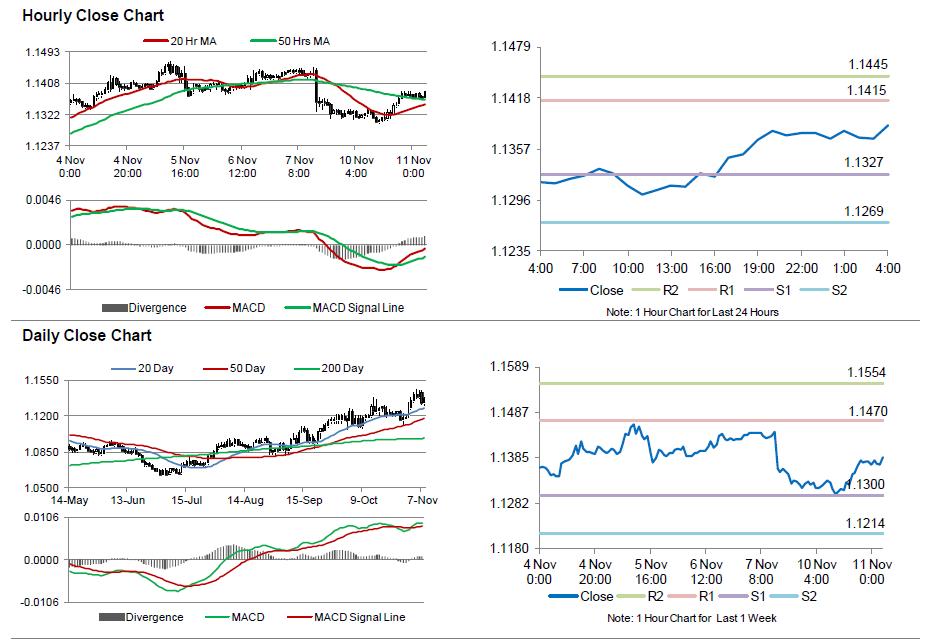

The pair is expected to find support at 1.1327, and a fall through could take it to the next support level of 1.1269. The pair is expected to find its first resistance at 1.1415, and a rise through could take it to the next resistance level of 1.1445.

Amid no economic releases from Canada today, market sentiments would be governed by global macroeconomic news. Meanwhile, investors would await Canadian Finance Minister Joe Oliver’s fall fiscal update scheduled on Wednesday.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.