On Friday, the USD rose 0.34% against the CAD to close at 1.2535. The CAD lost ground, after retail sales in Canada retreated more than expected by 2.0% on a monthly basis, posting its biggest decline since April 2010 in December and compared to prior month’s 0.4% rise in November. Markets were expecting a dip of 0.4%.

In the Asian session, at GMT0400, the pair is trading at 1.2558, with the USD trading 0.18% higher from Friday’s close.

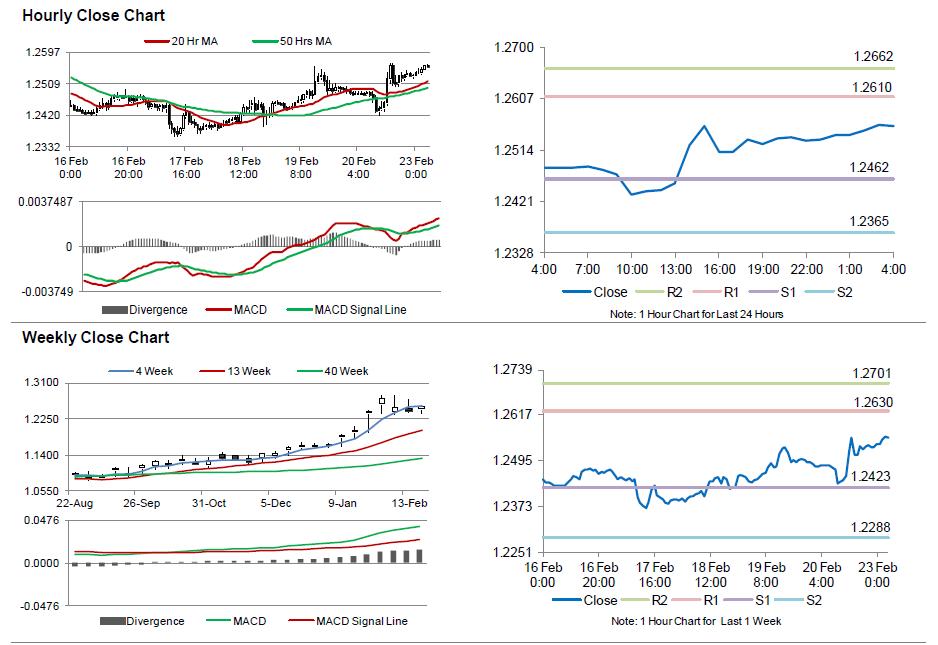

The pair is expected to find support at 1.2462, and a fall through could take it to the next support level of 1.2365. The pair is expected to find its first resistance at 1.2610, and a rise through could take it to the next resistance level of 1.2662.

Amid no economic releases in Canada today, investor sentiment would be governed by global macroeconomic news.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.