On Friday, the USD declined 0.60% against the CAD to close at 1.0755. The Canadian Dollar advanced after data showed that consumer inflation rate in Canada rose more-than-expected to 2.3% (YoY) in May, for the first time in more than two years and after another report revealed that Canadian retail sales rose 1.1% in April, its biggest monthly increase in nearly a year.

In the Asian session, at GMT0300, the pair is trading at 1.0727, with the USD trading 0.26% lower from Friday’s close.

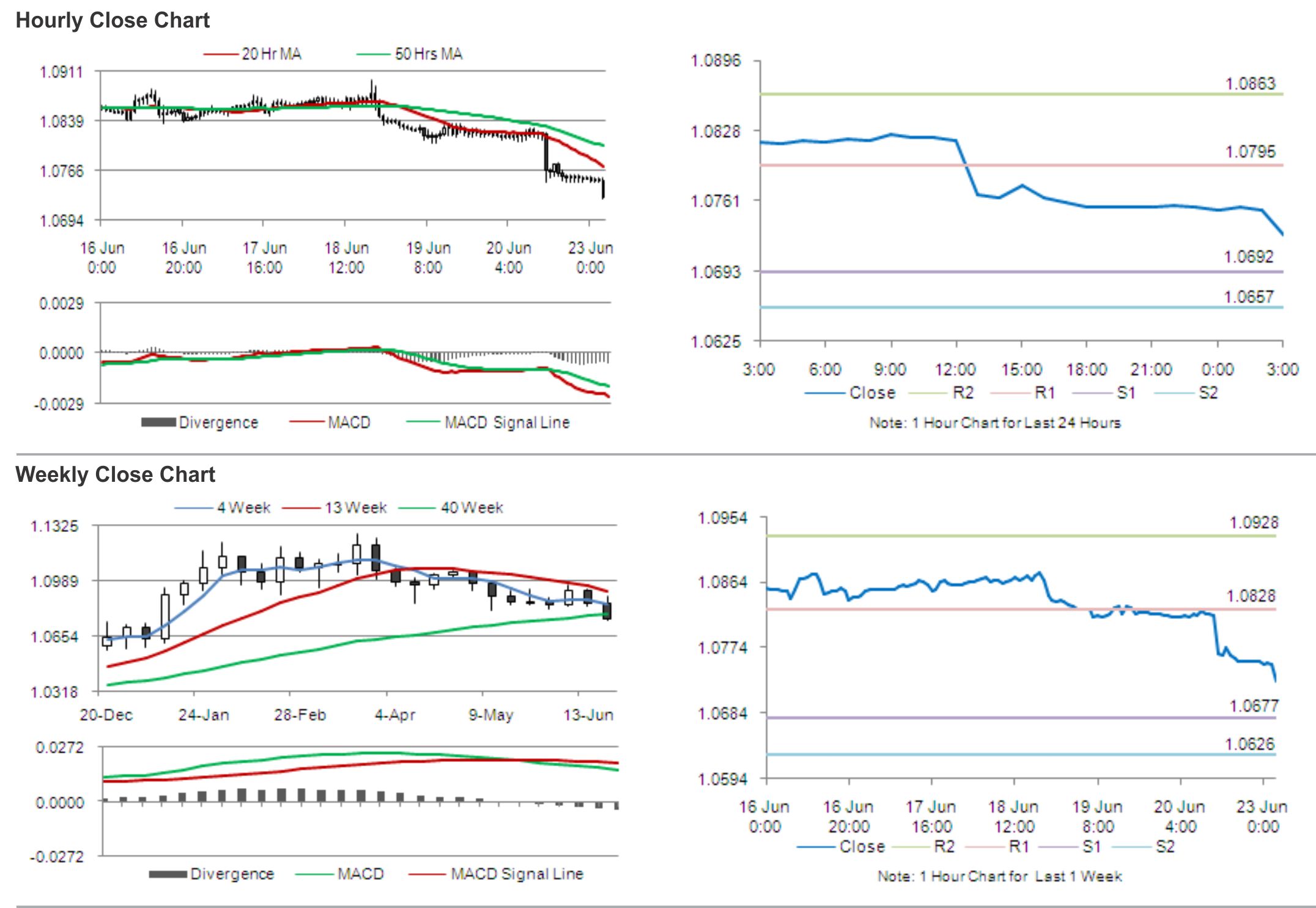

The pair is expected to find support at 1.0692, and a fall through could take it to the next support level of 1.0657. The pair is expected to find its first resistance at 1.0795, and a rise through could take it to the next resistance level of 1.0863.

Amid a lack of major economic releases in Canada, during the later course of the day, market participants are expected to closely monitor global economic news for further guidance in the currency pair.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.