For the 24 hours to 23:00 GMT, USD declined 0.37% against the CAD to close at 0.9967, as risk appetite rose after upbeat economic data in the US.

In the US, initial jobless claims unexpectedly fell by 13,000 to 348,000 in the week ended 11 February 2012, marking the lowest level since 2008, while the Federal Reserve Bank of Philadelphia reported that its index of current activity jumped to 10.2 in February.

Meanwhile, in Canada, manufacturing sales grew 0.6% (MoM) in December, compared to a 2.0% increase recorded in November. Also, foreign investment in Canadian securities dropped to $7.38 billion in December.

In the Asian session, at GMT0400, the pair is trading at 0.9959, with the USD trading 0.08% lower from yesterday’s close.

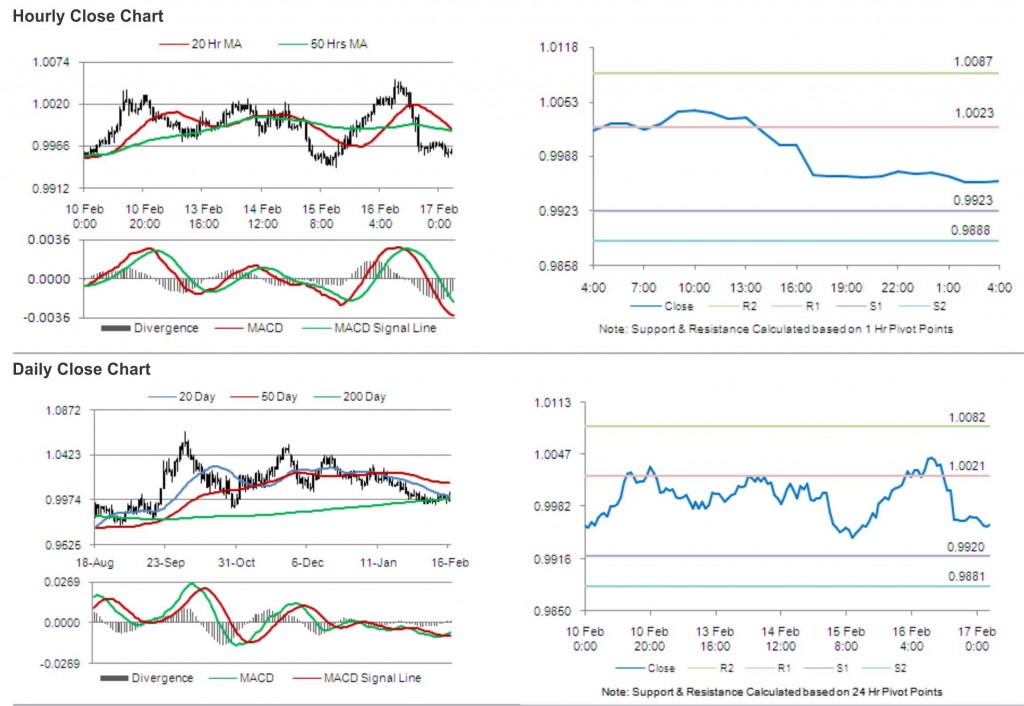

The pair is expected to find support at 0.9923, and a fall through could take it to the next support level of 0.9888. The pair is expected to find its first resistance at 1.0023, and a rise through could take it to the next resistance level of 1.0087.

Trading trends in the pair today are expected to be determined by the release of Canadian Consumer Price Index.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.