For the 24 hours to 23:00 GMT, the USD rose 0.22% against the CAD to close at 1.0764.

On the macro front, data released indicated that the foreign investors have remained net buyers of C$21.43 billion worth of Canadian securities in May, from being net buyers of a revised C$10.2 billion worth of Canadian securities in the previous month. Meanwhile, Canadian investors have remained net buyers of C$2.03 billion worth of foreign securities in May, from being net buyers of a revised C$2.27 billion worth of foreign securities in the prior month.

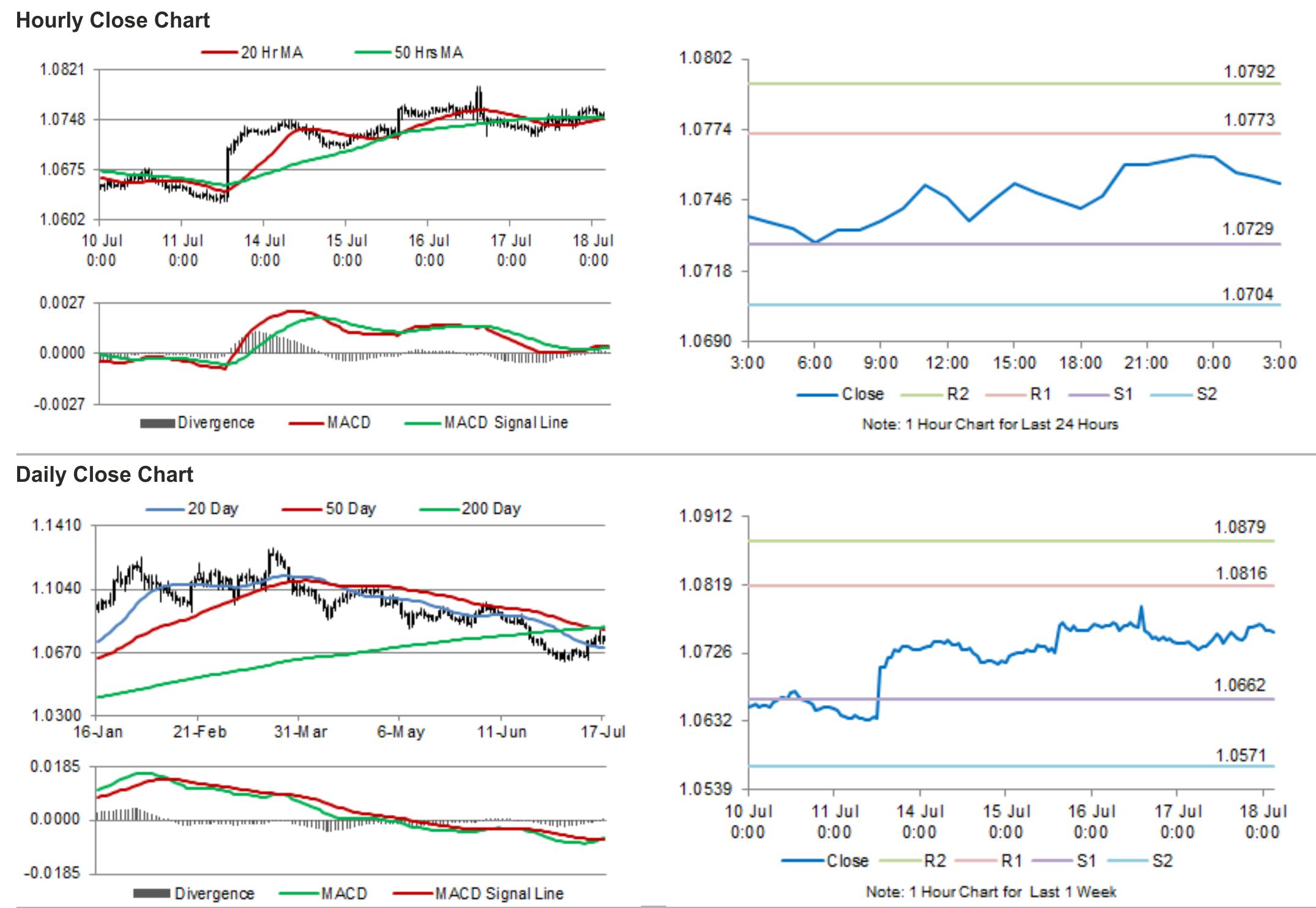

In the Asian session, at GMT0300, the pair is trading at 1.0753, with the USD trading 0.10% lower from yesterday’s close.

The pair is expected to find support at 1.0729, and a fall through could take it to the next support level of 1.0704. The pair is expected to find its first resistance at 1.0773, and a rise through could take it to the next resistance level of 1.0792.

Trading trends in the pair today are expected to be determined by the crucial inflation data from Canada slated to release later during the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.