For the 24 hours to 23:00 GMT, the USD rose 0.39% against the CAD and closed at 1.3006.

On the data front, Canada’s seasonally adjusted Ivey purchasing managers’ index rose more-than-expected to a level of 51.7 in June, after recording a reading of 49.4 in the preceding month and compared to market expectations for a rise to a level of 51.2. On the other hand, the nation’s building permits unexpectedly fell by 1.9% in May, following a revised gain of 0.1% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.3003, with the USD trading marginally lower against the CAD from yesterday’s close.

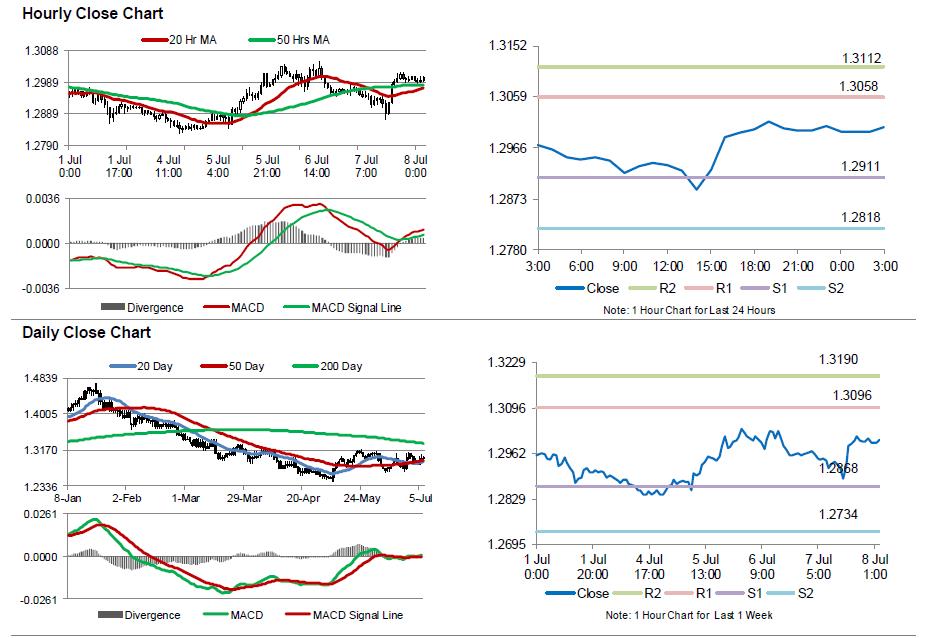

The pair is expected to find support at 1.2911, and a fall through could take it to the next support level of 1.2818. The pair is expected to find its first resistance at 1.3058, and a rise through could take it to the next resistance level of 1.3112.

Going ahead, market participants await the release of Canada’s unemployment rate data for June, due later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.