For the 24 hours to 23:00 GMT, the USD declined 0.08% against the CAD to close at 1.0968, despite robust retail sales data which rose at the fastest pace since September 2012.

Meanwhile, the Loonie continued to gain ground against the US Dollar, as investors remained cautious ahead of Bank of Canada’s interest rate decision scheduled to be released on Wednesday.

On the economic front, Teranet and the National Bank of Canada reported that the composite house price index in Canada came in at a steady reading of 160.42 in March, following a 0.3% (MoM) gain recorded in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.0974, with the USD trading slightly higher from yesterday’s close.

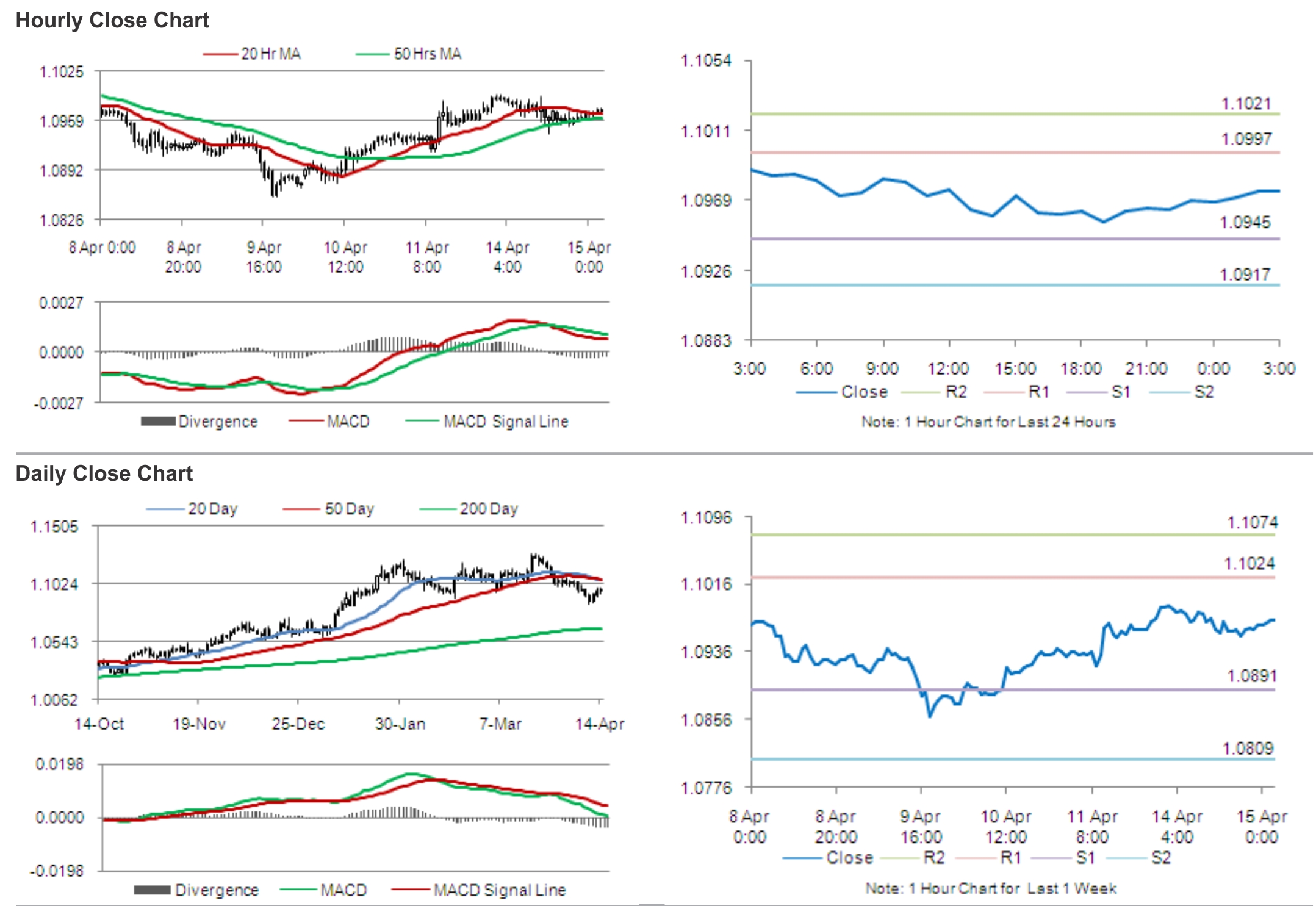

The pair is expected to find support at 1.0945, and a fall through could take it to the next support level of 1.0917. The pair is expected to find its first resistance at 1.0997, and a rise through could take it to the next resistance level of 1.1021.

Market participants are expected to keep a tab on the release of Canada’s manufacturing shipment data, slated later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.