For the 24 hours to 23:00 GMT, the USD rose 0.20% against the CAD to close at 1.2310.

The CAD remained under pressure, as consumer prices in Canada unexpectedly eased 0.1% MoM in April, reversing market expectations for a 0.1% advance and falling below the central bank’s target band following a drop in energy costs. It had risen 0.7% in the preceding month.

Other economic data showed that Canada’s retail sales advanced 0.7% on a monthly basis in March, beating market expectations for a 0.3% increase and compared to a revised rise of 1.5% recorded in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.2315, with the USD trading marginally higher from yesterday’s close.

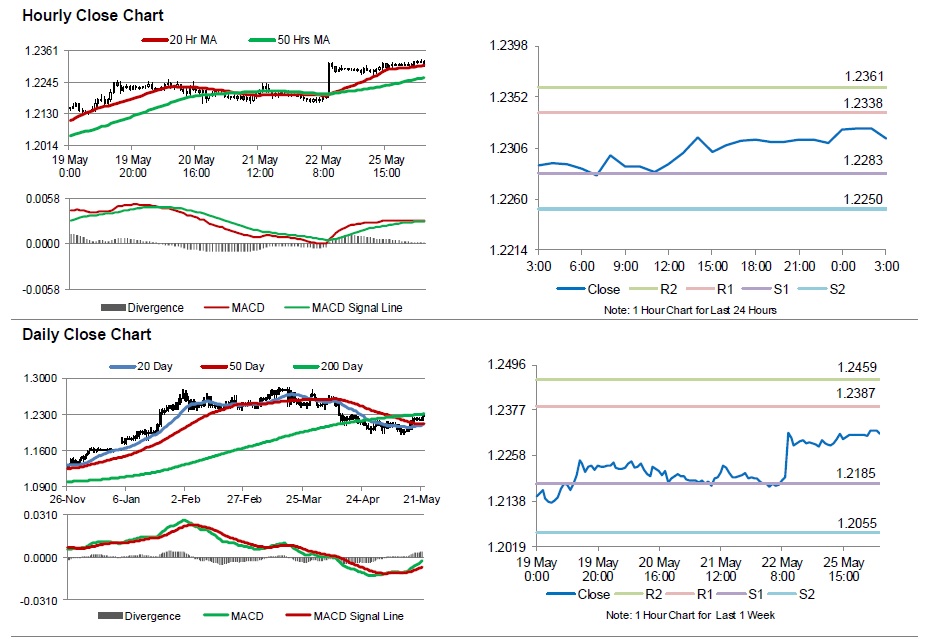

The pair is expected to find support at 1.2283, and a fall through could take it to the next support level of 1.2250. The pair is expected to find its first resistance at 1.2338, and a rise through could take it to the next resistance level of 1.2361.

Going forward, traders are gearing up for the BoC’s interest rate announcement, scheduled tomorrow.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.