For the 24 hours to 23:00 GMT, the USD rose 0.28% against the CAD to close at 1.0683.

The Canadian Dollar lost momentum, after the release of largely disappointing data from Canada. The Ivey PMI reading unexpectedly retreated to a reading of 46.9 in June, from a reading of 48.2 in the previous month. Markets were expecting the index to rise to a reading of 52.5. Additionally, the BoC’s survey of senior loan officers on business lending practices in Canada showed that credit conditions worsened to a level of -12.8 in Q2 2014, following a decline to a level of -10.9 in the previous quarter. The business outlook future sales data too deteriorated to a level of 24.0 in the second quarter, from a level of 27.0 in the previous quarter. Market had expected the reading to rise to a level of 30.0. However Canadian building permits for May surpassed expectations and rose at the fastest pace in 10 months.

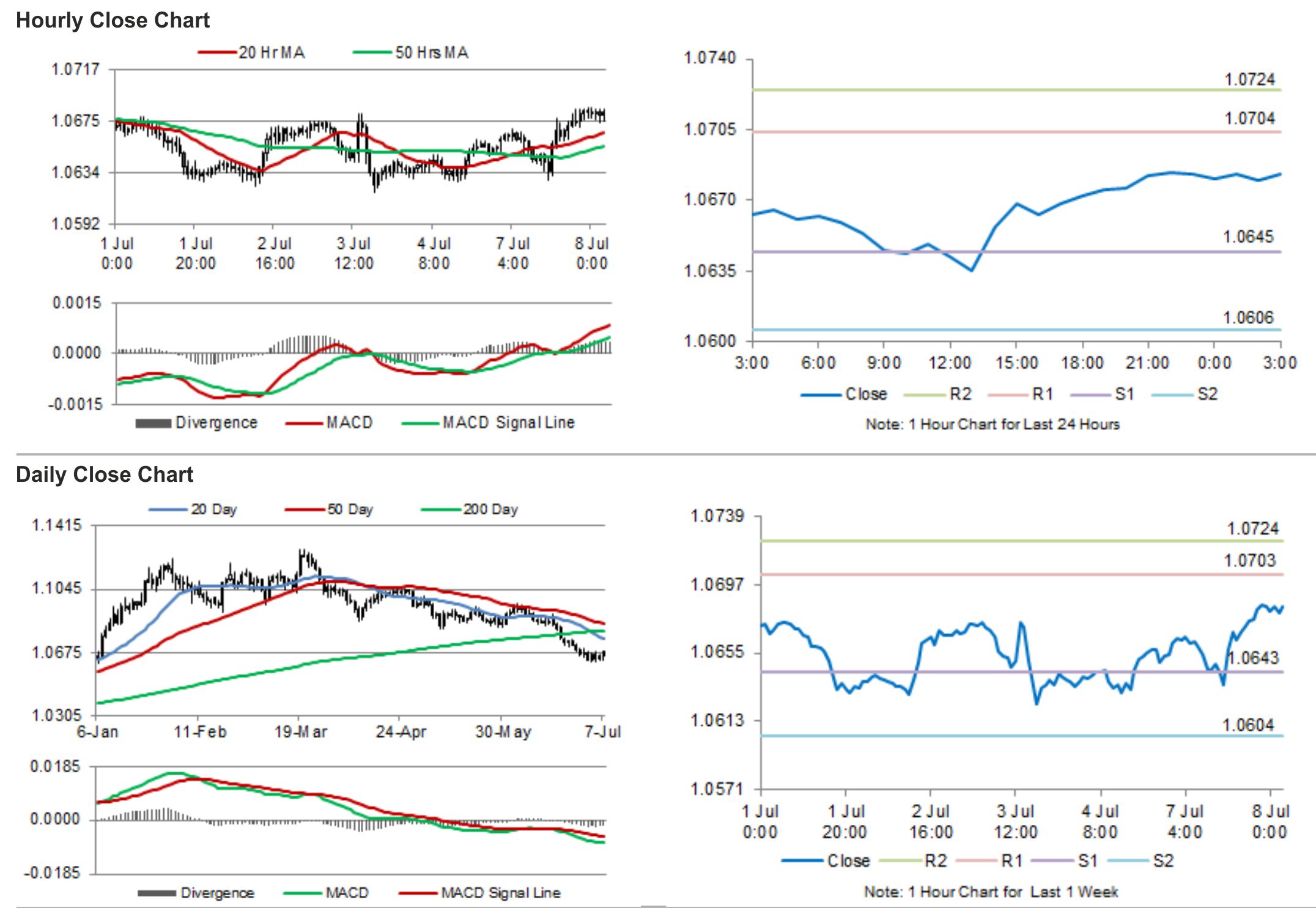

In the Asian session, at GMT0300, the pair is trading at 1.0683, with the USD trading flat from yesterday’s close.

The pair is expected to find support at 1.0645, and a fall through could take it to the next support level of 1.0606. The pair is expected to find its first resistance at 1.0704, and a rise through could take it to the next resistance level of 1.0724.

With no economic releases from Canada scheduled today, trading trends in the pair today are expected to be determined by global factors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.