For the 24 hours to 23:00 GMT, the USD rose 0.61% against the CAD to close at 1.1128, after a report showed that the number of building permits issued in the US rose more than expected to a four month high.

The Canadian Dollar came under pressure, after the Bank of Canada Governor, Stephen Poloz hinted towards potential weakness in the Canadian economy in the first quarter of the year and didn’t rule out an interest rate cut. He elaborated that inflation would likely be tepid in February, while growth in the first quarter in the year would be on the “soft side”. However, the Canadian Dollar moved higher for a brief period of time after Canadian manufacturing shipments rose more than projected in January. The Statistics Canada reported that on a monthly basis, manufacturing shipments in Canada rose 1.5% in January, compared to a revised 1.5% decrease recorded in the previous month. Markets were expecting manufacturing shipments to climb 0.5% in January.

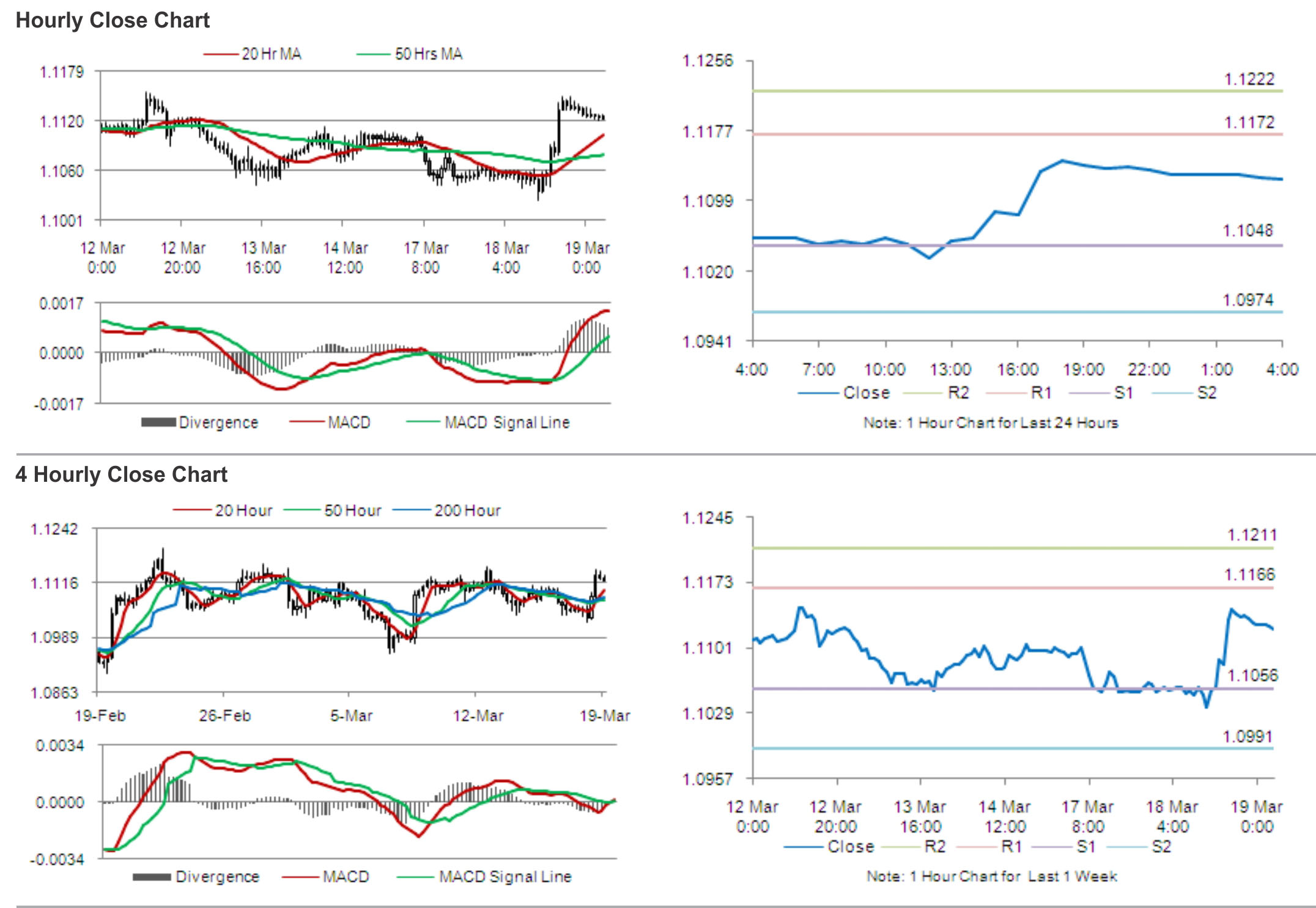

In the Asian session, at GMT0400, the pair is trading at 1.1122, with the USD trading 0.05% lower from yesterday’s close.

The pair is expected to find support at 1.1048, and a fall through could take it to the next support level of 1.0974. The pair is expected to find its first resistance at 1.1172, and a rise through could take it to the next resistance level of 1.1222.

With a void of major releases from Canada today, trading trends for this pair would be determined by the FOMC meeting.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.