For the 24 hours to 23:00 GMT, USD declined 1.17% against the CAD, on Friday, to close at 1.0109. Canadian dollar rose on investors’ optimism that the European officials are making progress in designing a rescue plan to contain region’s debt crisis.

In the US, the Reuters/Michigan Consumer Sentiment Index declined to 57.5 in October, compared to 59.4 in September.

In Canada, the manufacturing shipments increased 1.4% (M-o-M) to C$47.6 billion in August, following 3.1% growth in July.

In the Asian session, at GMT0300, the pair is trading at 1.0103, with the USD trading 0.06% lower from Friday’s close.

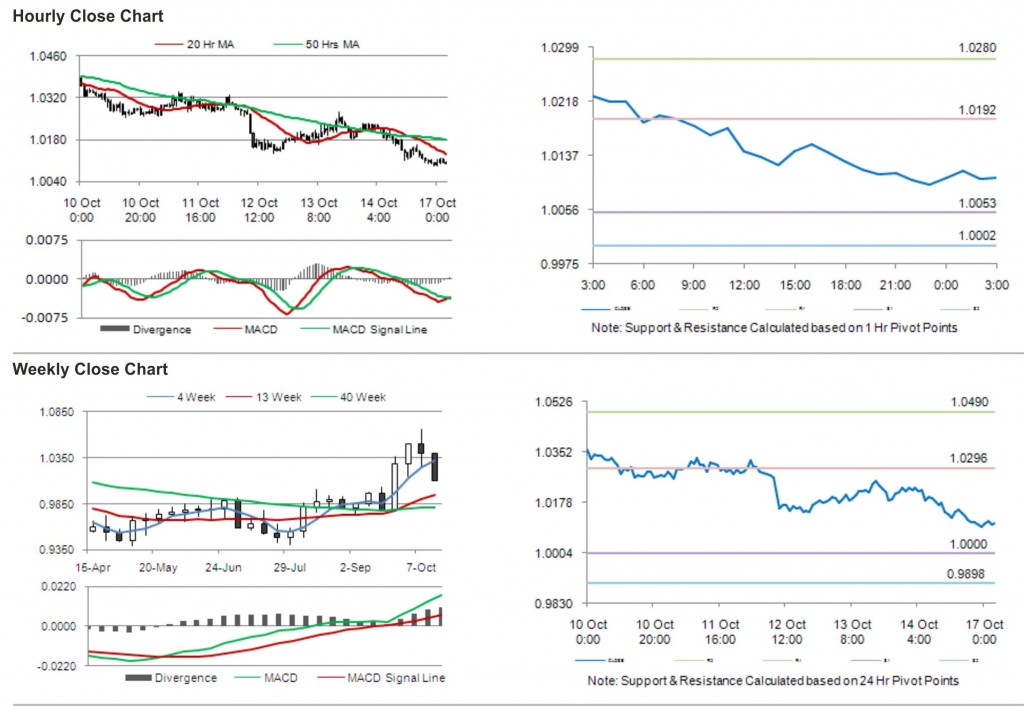

The pair is expected to find support at 1.0053, and a fall through could take it to the next support level of 1.0002. The pair is expected to find its first resistance at 1.0192, and a rise through could take it to the next resistance level of 1.0280.

The pair is expected to trade on the cues from the release of data on Canadian investment in foreign securities and foreign investment in Canadian securities.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.