For the 24 hours to 23:00 GMT, USD rose 0.65% against the CAD to close at 0.9584.

In the US, the ADP national employment report showed that the private sector employment increased by 157,000 jobs in June following a downwardly revised increase of 36,000 jobs in May. The initial jobless claims registered a drop to 418,000 in the week ending July 2, from the previous week’s revised figure of 432,000. Additionally, the continuing jobless claims also registered a drop to 3.681 million in the week ending June 25, from the previous week’s revised figure of 3.724 million.

In Canada, the new housing price index rose by 0.4% (M-o-M) in May from 0.3% rise in the previous month. Additionally, the Ivey Purchasing Managers Index (PMI) decreased to a reading of 59.9 in June, from 65.5 in May.

In the Asian session at 3:00GMT, the pair is trading at 0.9590, 0.06% higher from yesterday’s close at 23:00 GMT.

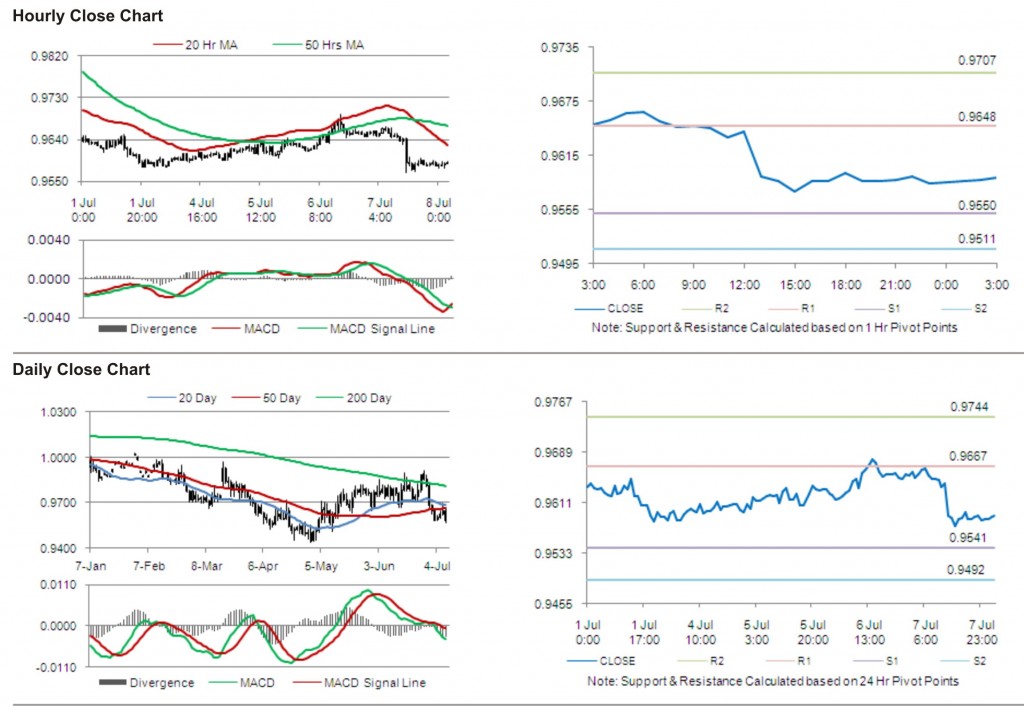

The first area of short term resistance is observed at 0.9648, followed by 0.9707 and 0.9805. The first area of support is at 0.9550, with the subsequent supports at 0.9511 and 0.9413.

Trading trends in the pair today are expected to be determined by release of unemployment rate data in Canada.

The currency pair is trading below its 20 Hr and its 50 Hr moving averages.