For the 24 hours to 23:00 GMT, the USD rose 0.09% against the CAD and closed at 1.2695.

On the data front, Canada’s international merchandise trade deficit narrowed more-than-expected to C$1.47 billion in October, following a revised deficit of C$3.36 billion in the prior month. Market participants had anticipated the nation’s international merchandise trade deficit to drop to C$2.70 billion.

In the Asian session, at GMT0400, the pair is trading at 1.2695, with the USD trading flat against the USD from yesterday’s close.

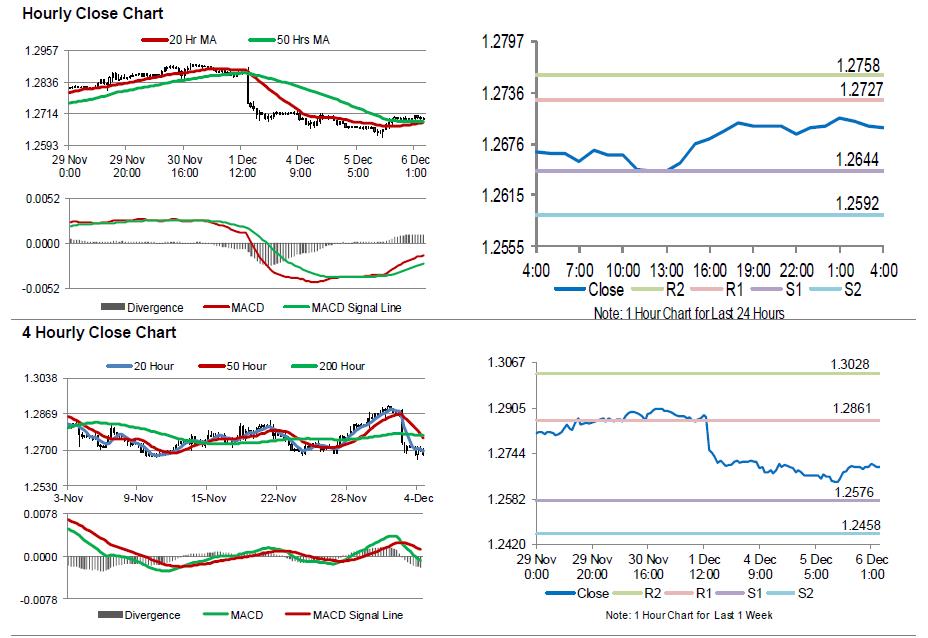

The pair is expected to find support at 1.2644, and a fall through could take it to the next support level of 1.2592. The pair is expected to find its first resistance at 1.2727, and a rise through could take it to the next resistance level of 1.2758.

Trading trend in the CAD today is expected to be determined by the Bank of Canada’s (BoC) interest rate decision, due to be announced later in the day. Investors broadly anticipate the central bank to remain pat on monetary policy.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.