For the 24 hours to 23:00 GMT, the USD rose 0.18% against the CAD and closed at 1.3139.

Data showed that, Canada’s seasonally adjusted housing starts jumped to a level of 248.1K in June, signalling strength in consumer purchasing power and compared to a revised level of 193.9K in the prior month. Market participants had envisaged housing starts to climb to a level of 210.0K.

Meanwhile, the nation’s building permits unexpectedly jumped 4.7% on a monthly basis in May, defying market expectations for a flat reading. In the previous month, building permits had fallen by a revised 4.7%.

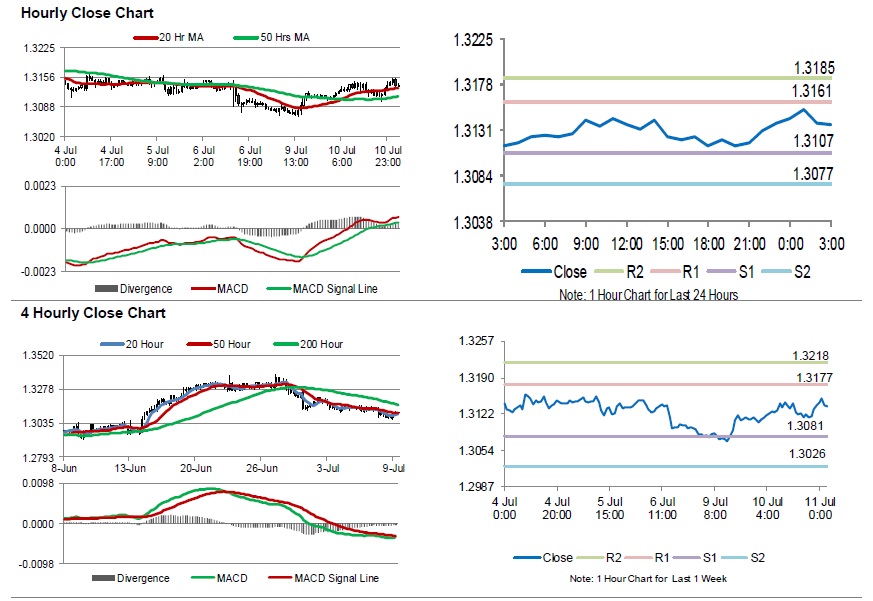

In the Asian session, at GMT0300, the pair is trading at 1.3137, with the USD trading marginally lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.3107, and a fall through could take it to the next support level of 1.3077. The pair is expected to find its first resistance at 1.3161, and a rise through could take it to the next resistance level of 1.3185.

Moving forward, traders would keep an eye on the Bank of Canada’s (BoC) interest rate decision, slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.