For the 24 hours to 23:00 GMT, the USD rose 0.30% against the CAD to close at 1.4120.

The CAD lost ground, after Canada’s seasonally adjusted Ivey purchasing managers index contracted for the first time in nine months to a level of 49.9 in December, underlining concerns over the health of the nation’s economy, after registering a reading of 63.6 in the previous month. Market anticipation was for the index to fall to a level of 55.0.

Separately, the BoC Governor, Stephen Poloz, indicated that the central bank will continue to run an independent monetary policy aimed at achieving its inflation target of 2.0% and that the Canadian Dollar is likely to stay low for the foreseeable future.

In the Asian session, at GMT0400, the pair is trading at 1.4079, with the USD trading 0.29% lower from yesterday’s close.

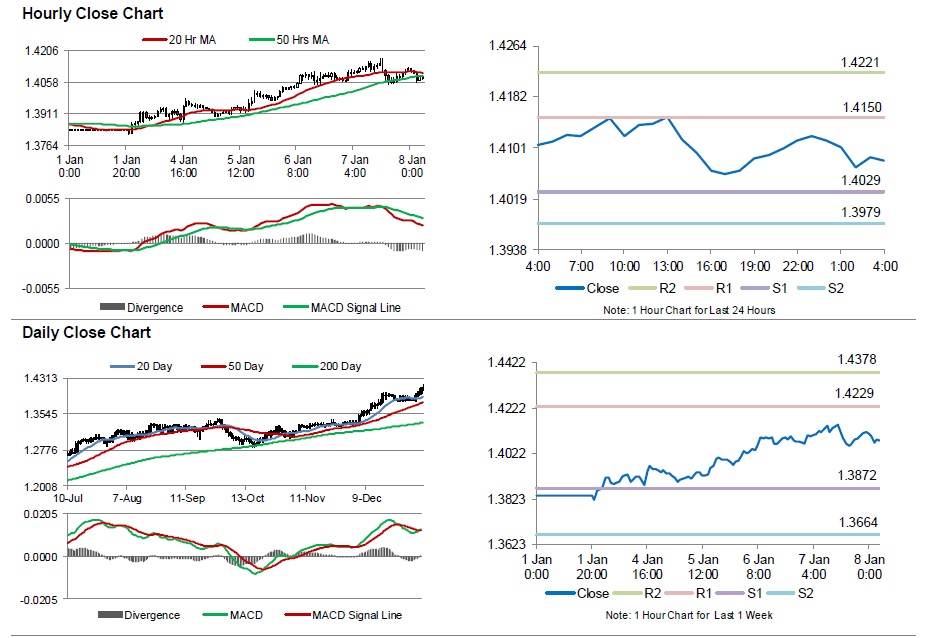

The pair is expected to find support at 1.4029, and a fall through could take it to the next support level of 1.3979. The pair is expected to find its first resistance at 1.4150, and a rise through could take it to the next resistance level of 1.4221.

Going ahead, investors will concentrate on Canada’s unemployment rate and building permits data, scheduled to be released later in the day.

The currency pair is trading below its 20 Hr moving average and is showing convergence with its 50 Hr moving average.