For the 24 hours to 23:00 GMT, the USD declined 0.27% against the CAD to close at 1.2706.

The CAD gained ground, after Canada’s seasonally adjusted housing starts registered an11-month high level of 202.80 K units in June, following a downwardly revised reading of 197.0 K units in May, while markets were expecting it to drop to 190.0 K. Incited by a rise of 0.5% in the hot housing market of Toronto, the new home prices in the country rose more than expected by 0.2% on a monthly basis in May.

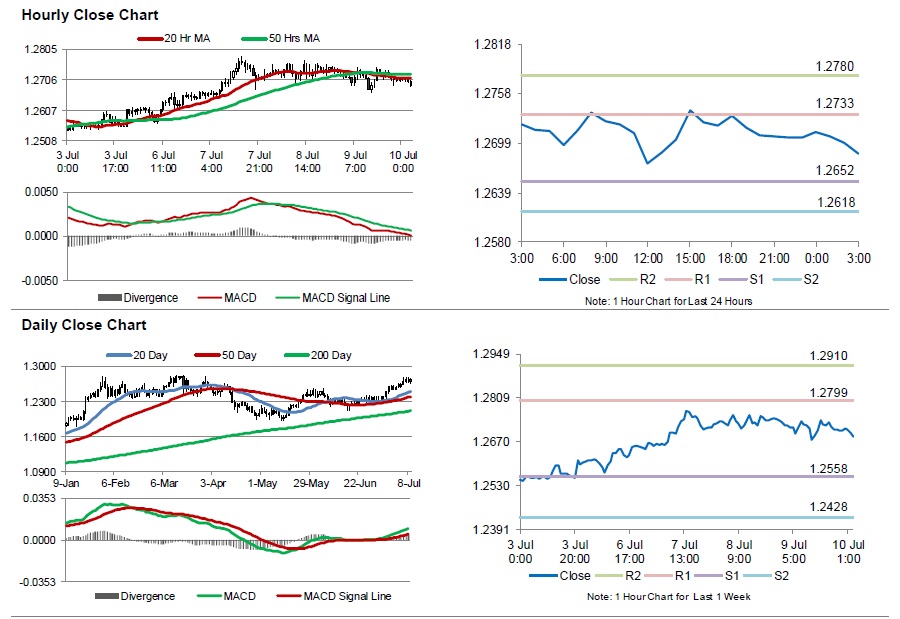

In the Asian session, at GMT0300, the pair is trading at 1.2687, with the USD trading 0.15% lower from yesterday’s close.

The pair is expected to find support at 1.2652, and a fall through could take it to the next support level of 1.2618. The pair is expected to find its first resistance at 1.2733, and a rise through could take it to the next resistance level of 1.2780.

Meanwhile, investors would keep a close eye on Canada’s unemployment rate data, scheduled later today for further cues.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.