For the 24 hours to 23:00 GMT, the USD declined marginally against the CAD to close at 1.4117.

The Canadian dollar gained ground, after Canada’s unemployment rate remained steady at 7.1% in December, in line with investor expectations. Net number of people employed in the country rose more-than-expected by 22.8K in December, compared to a decline of 35.7K in the previous month and against investor expectations for an advance of 8.0K.

On the other hand, the nation’s building permits plummeted 19.6% MoM in November, higher than market expectations for a fall of 2.9%, following a revised rise of 9.9% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.4165, with the USD trading 0.35% higher from Friday’s close.

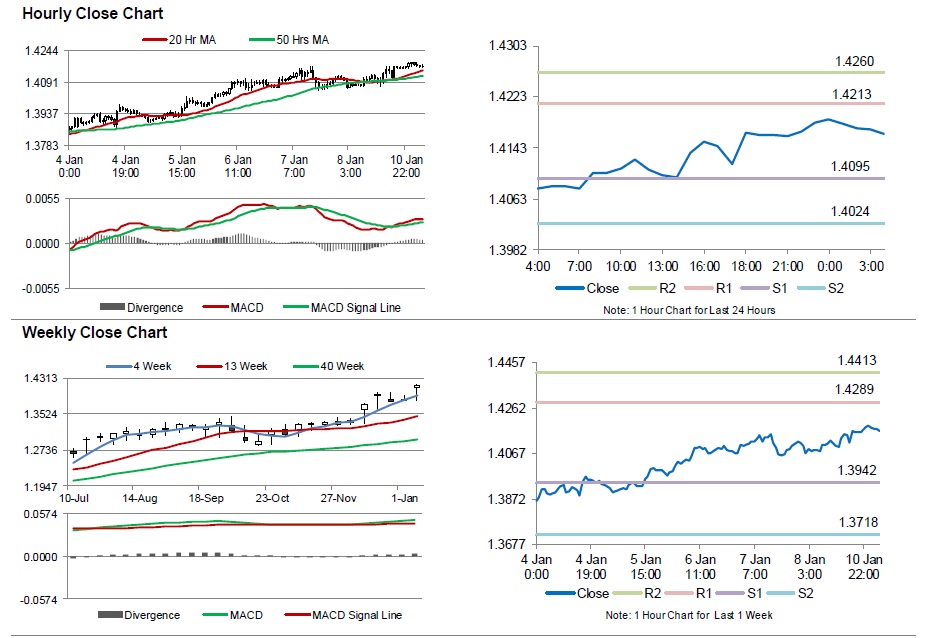

The pair is expected to find support at 1.4095, and a fall through could take it to the next support level of 1.4024. The pair is expected to find its first resistance at 1.4213, and a rise through could take it to the next resistance level of 1.4260.

Going ahead, market participants will concentrate on Canada’s housing starts data for December and the BoC’s business outlook survey, scheduled to release later today, for further cues.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.