For the 24 hours to 23:00 GMT, the USD declined 0.39% against the CAD to close at 1.2690, following weak advance retail sales data for February in the US.

On the macro front, the new housing price index in Canada retreated 0.1% MoM in February, following a 0.2% rise registered in the prior month.

Separately, a leading bank in Canada slashed the nation’s economic growth forecast for 2015 to 2.4%, from its previous estimation of 2.7% expansion because of continued low oil prices. However, the bank assured the economic growth in the nation to be slow, but not “derail”, as a rise consumer spending and growth in exports would make up for the losses caused by the recent plunge in oil prices.

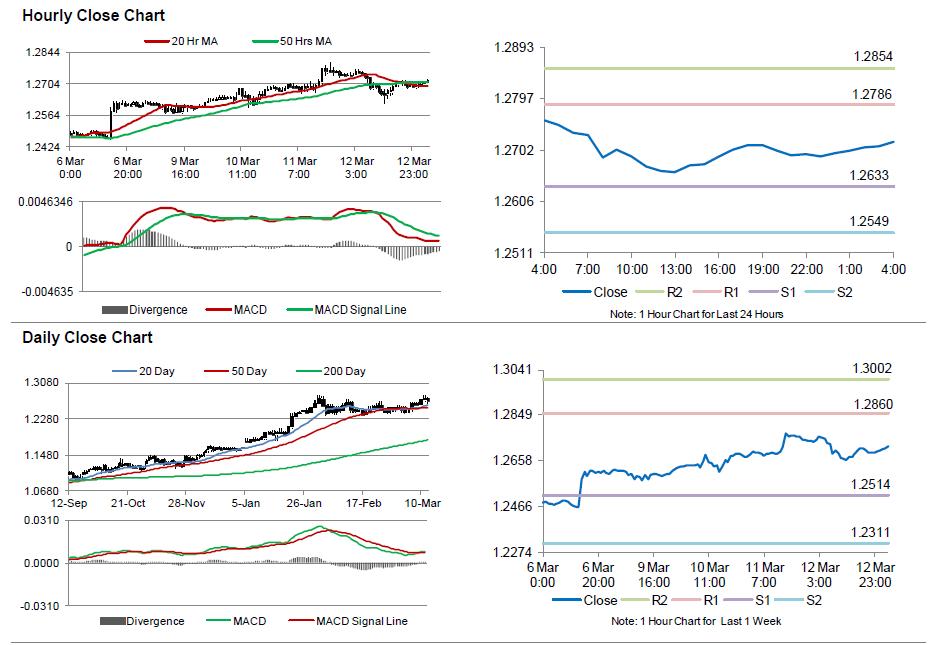

In the Asian session, at GMT0400, the pair is trading at 1.2717, with the USD trading 0.21% higher from yesterday’s close.

The pair is expected to find support at 1.2633, and a fall through could take it to the next support level of 1.2549. The pair is expected to find its first resistance at 1.2786, and a rise through could take it to the next resistance level of 1.2854.

Looking ahead, investors await Canada’s unemployment rate data, scheduled later today to get better insights in the nation’s economy.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.