For the 24 hours to 23:00 GMT, the USD rose 0.21% against the CAD to close at 1.0991. The CAD extended its Friday session losses triggered by the release of dismal inflation data.

The consumer prices in Canada fell 0.2% in July, on a monthly basis, compared to market expectations of a drop of 0.1%. In another important release, retail sales in the nation rose 1.1% (M-o-M) in June, beating market expectations for a 0.3% gain. This follows an advance of 0.7% in May.

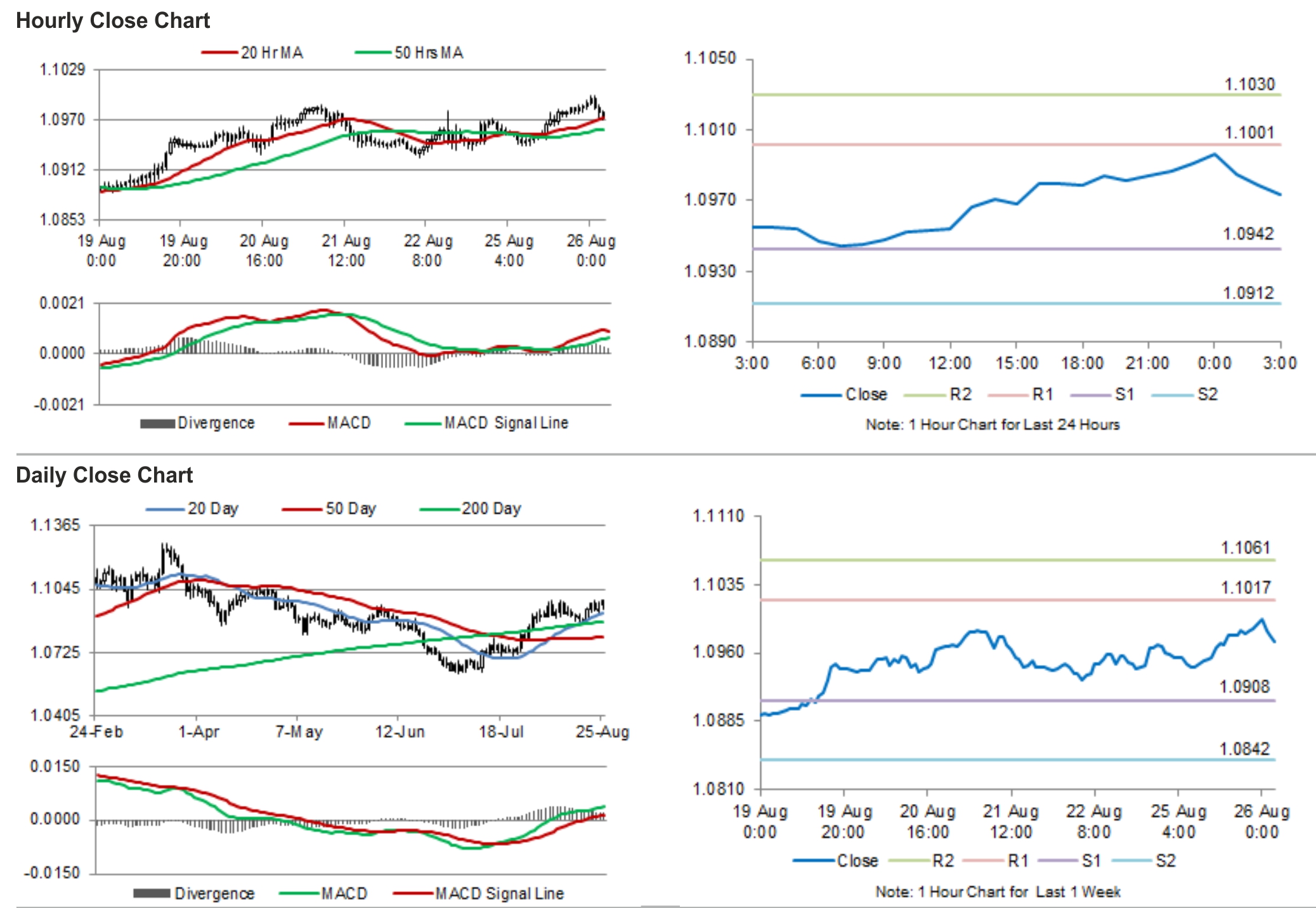

In the Asian session, at GMT0300, the pair is trading at 1.0973, with the USD trading 0.16% lower from yesterday’s close.

The pair is expected to find support at 1.0942, and a fall through could take it to the next support level of 1.0912. The pair is expected to find its first resistance at 1.1001, and a rise through could take it to the next resistance level of 1.1030.

Investors will focus on Friday’s GDP numbers, the only major economic release for Canada this week.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.