For the 24 hours to 23:00 GMT, the USD declined 0.24% against the CAD and closed at 1.3148.

On the economic front, Canada’s new housing price index advanced less-than-anticipated by 0.2% MoM in November, compared to an advance of 0.4% in the previous month, whereas markets were anticipating the index to climb 0.3%. Further, the nation’s Teranet/National Bank house price index rose 0.3% on a monthly basis in December, after registering a gain of 0.2% in the prior month.

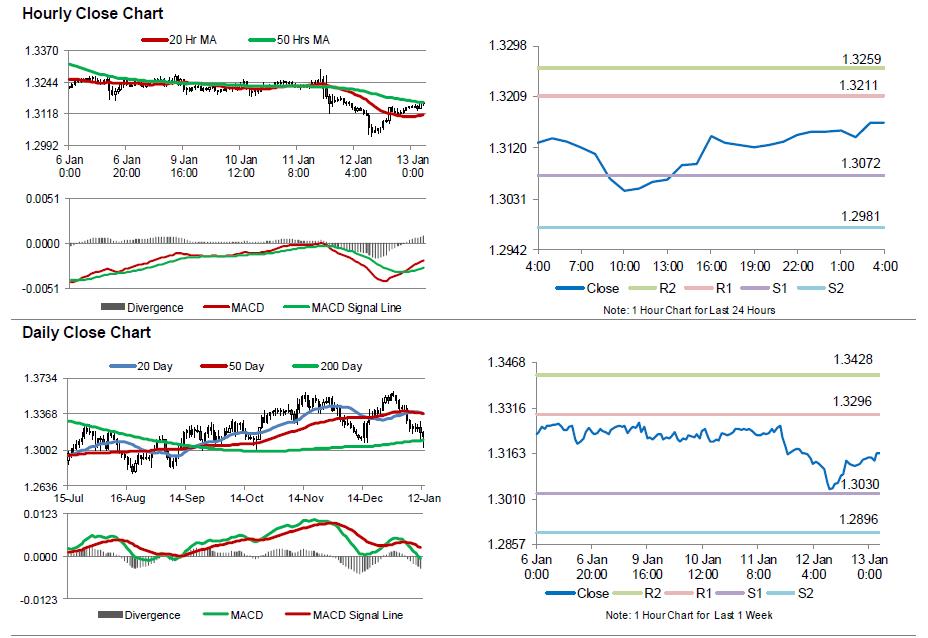

In the Asian session, at GMT0400, the pair is trading at 1.3164, with the USD trading 0.12% higher against the CAD from yesterday’s close.

The pair is expected to find support at 1.3072, and a fall through could take it to the next support level of 1.2981. The pair is expected to find its first resistance at 1.3211, and a rise through could take it to the next resistance level of 1.3259.

This afternoon will bring a crucial Canadian release, namely existing home sales for December, slated to release later in the day.

The currency pair is trading its 20 Hr and 50 Hr moving average.