For the 24 hours to 23:00 GMT, the USD rose marginally against the CAD to close at 1.3360.

The CAD lost ground on the back of weak Canadian GDP and manufacturing sector performance.

Data showed that Canada’s GDP fell more-than-expected by 0.5% MoM in September, after recording a rise of 0.1% in the previous month, while investors had expected it to remain flat. Moreover, the nation’s RBC manufacturing PMI edged up to a level of 48.6 in November, but remained below the 50 mark threshold that signals growth. In the previous month, the index had recorded a reading of 48.0.

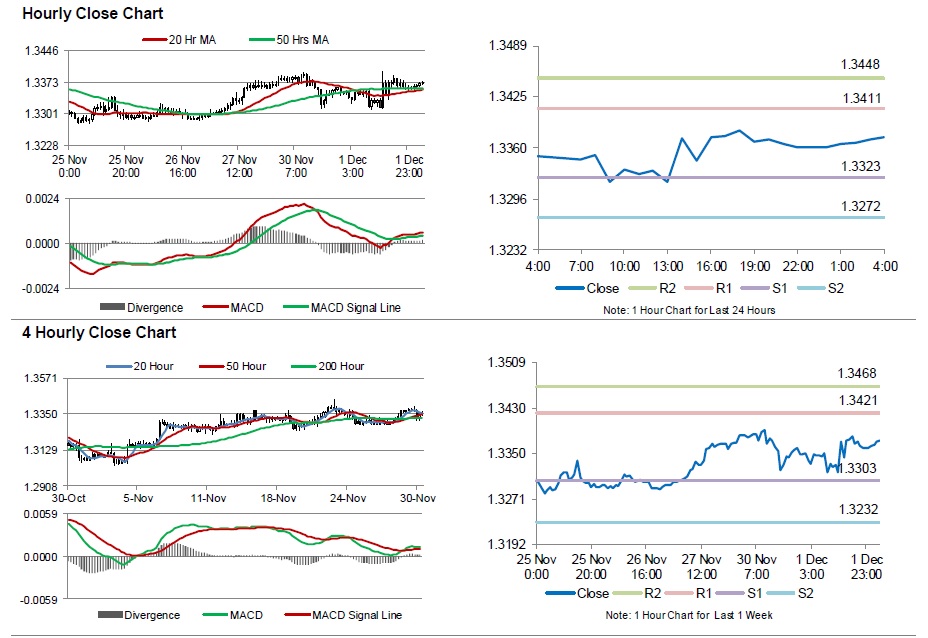

In the Asian session, at GMT0400, the pair is trading at 1.3373, with the USD trading 0.1% higher from yesterday’s close.

The pair is expected to find support at 1.3323, and a fall through could take it to the next support level of 1.3272. The pair is expected to find its first resistance at 1.3411, and a rise through could take it to the next resistance level of 1.3448.

Going ahead, investors will closely watch the BoC interest rate decision, scheduled to be announced later in the day, for further cues.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.