For the 24 hours to 23:00 GMT, the USD rose 0.25% against the CAD to close at 1.1985.

On the macro front, Canada’s new housing price index remained unchanged on a monthly basis in March, compared to a rise of 0.20% in the prior month. Markets were anticipating the index to rise 0.10%.

In the Asian session, at GMT0300, the pair is trading at 1.1998, with the USD trading 0.11% higher from yesterday’s close.

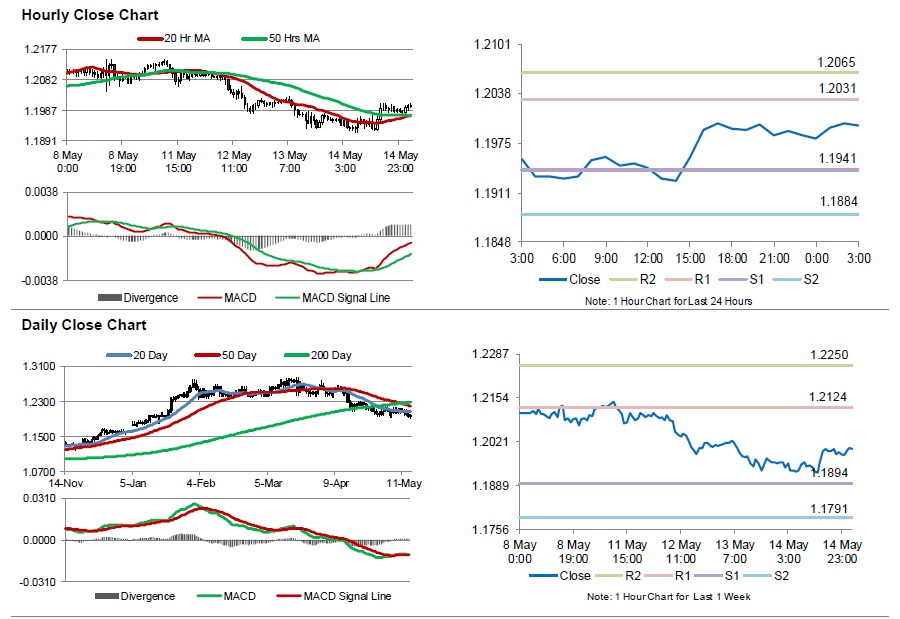

The pair is expected to find support at 1.1941, and a fall through could take it to the next support level of 1.1884. The pair is expected to find its first resistance at 1.2031, and a rise through could take it to the next resistance level of 1.2065.

Meanwhile, investors would closely monitor Canada’s existing homes sales data, scheduled in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.