For the 24 hours to 23:00 GMT, USD rose 0.58% against the CAD to close at 0.9581, as commodity prices declined.

In the US, the Dallas Federal Reserve Bank President Richard Fisher stated that he expects to argue for a tightening of the ongoing super-easy monetary policy when the circumstances and time are right. He also warned that central bankers must ensure surging commodity prices do not fuel a broad-based inflation surge.

In the Asian session at 3:00GMT, the pair is trading at 0.9590, 0.09% higher from the New York session close.

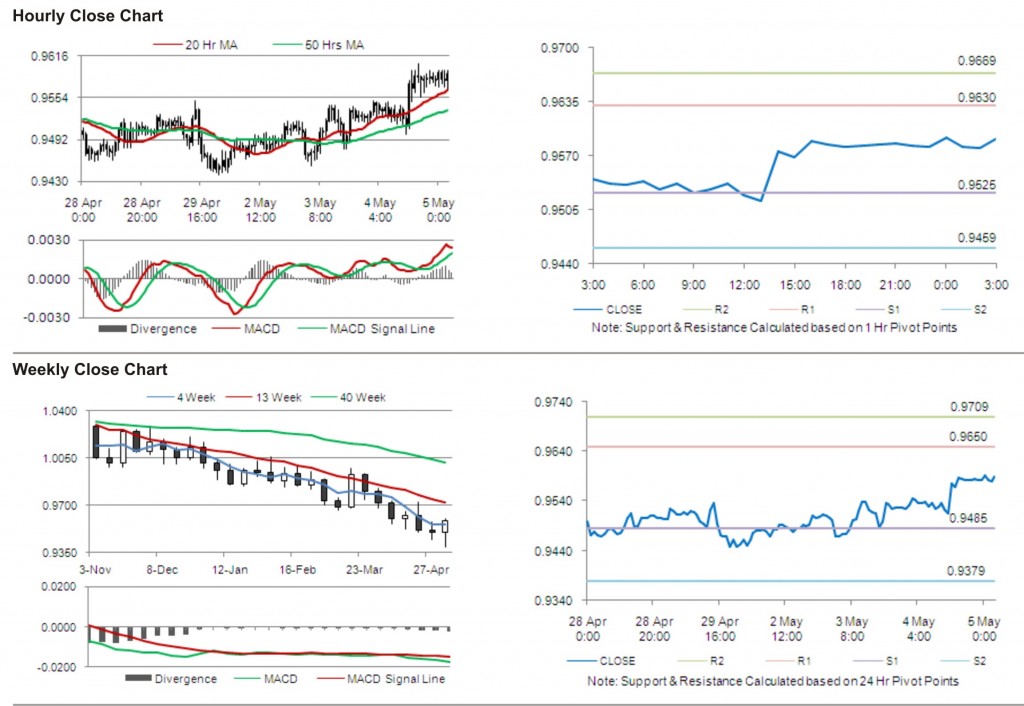

The first area of short term resistance is observed at 0.9630, followed by 0.9669 and 0.9774. The first area of support is at 0.9525, with the subsequent supports at 0.9459 and 0.9354 .

Trading trends in the pair today are expected to be determined by data release on building permits and Ivey purchasing managers index in Canada.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.