For the 24 hours to 23:00 GMT, the USD declined 0.13% against the CAD and closed at 1.3108.

On the data front, Canada’s manufacturing shipments rose by 0.9% MoM in August, rising to its highest level in seven months and surpassing market expectations for an advance of 0.3%. Manufacturing shipments recorded a gain of 0.1% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.3088, with the USD trading 0.15% lower against the CAD from yesterday’s close.

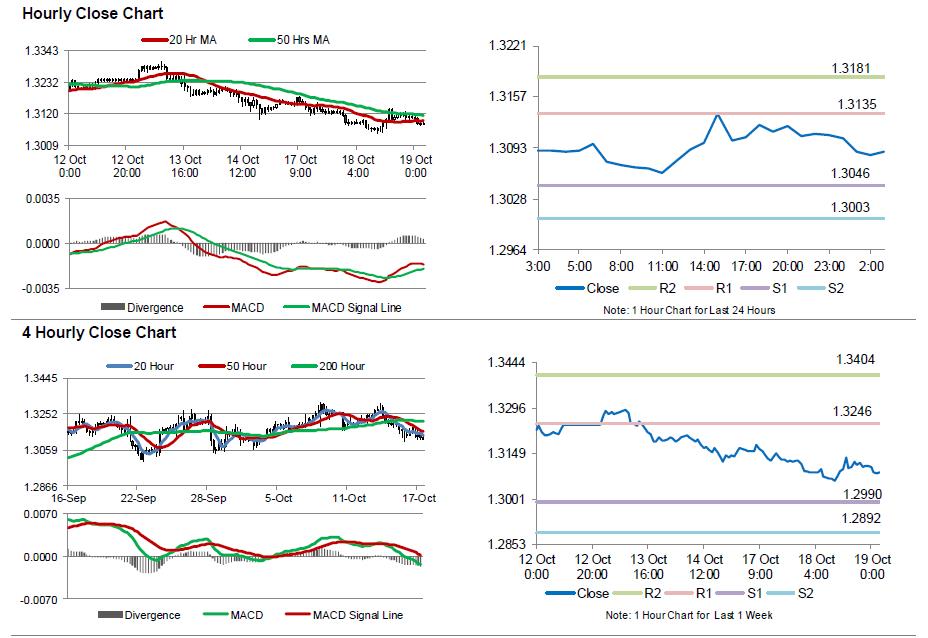

The pair is expected to find support at 1.3046, and a fall through could take it to the next support level of 1.3003. The pair is expected to find its first resistance at 1.3135, and a rise through could take it to the next resistance level of 1.3181.

Market participants keenly await the Bank of Canada’s (BoC) interest rate decision, scheduled to be announced later in the day, which is widely expected to remain steady at 0.50%.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.