For the 24 hours to 23:00 GMT, the USD declined 0.29% against the CAD to close at 1.2653.

Yesterday, the Bank of Canada (BoC) Governor, Stephen Poloz, indicated that it would likely take more than three years for the Canadian economy to recover from the low oil price shock. He further added that it could take even longer for the nation to reach a new equilibrium where the energy sector will have shrunk relatively to the whole economy and the rest of the economy will have grown to fill that void.

In other economic news, Canada’s wholesale sales declined more-than-expected by 2.2% MoM in February, its biggest monthly drop in more than a year, amid sharp declines in the machinery and auto sectors. Investors had expected it to fall by 0.4%, following a revised 0.2% rise in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.2645, with the USD trading 0.06% lower from yesterday’s close.

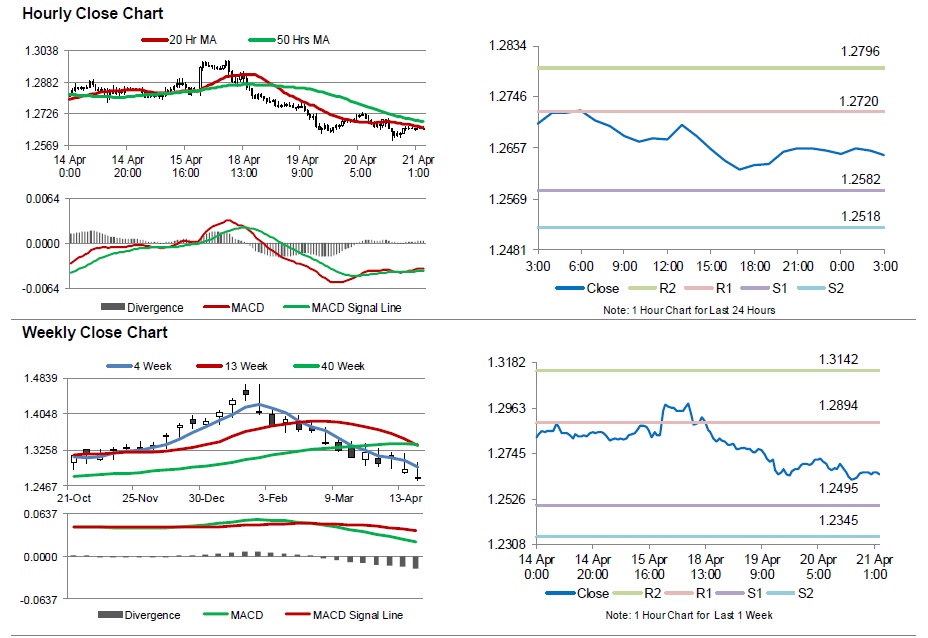

The pair is expected to find support at 1.2582, and a fall through could take it to the next support level of 1.2518. The pair is expected to find its first resistance at 1.2720, and a rise through could take it to the next resistance level of 1.2796.

Amid no economic releases in Canada today, market participants will look forward to the nation’s retail sales and consumer price index data, scheduled for release tomorrow.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.