For the 24 hours to 23:00 GMT, the USD rose 0.67% against the CAD to close at 1.1353.

On the macro front, Canadian RBC manufacturing PMI surged to 11-month high mark of 55.3 in October, up from a reading of 53.5 recorded in September.

Separately, the BoC Governor, Stephen Poloz indicated that interest rates in Canada would remain lower for prolonged period, citing soft recovery in the world economy. He further expressed concerns over the nation’s slow moving inflation but mentioned that the central bank’s current monetary policy remains appropriate to achieve its 2% inflation target.

In the Asian session, at GMT0400, the pair is trading at 1.1346, with the USD trading 0.06% lower from yesterday’s close.

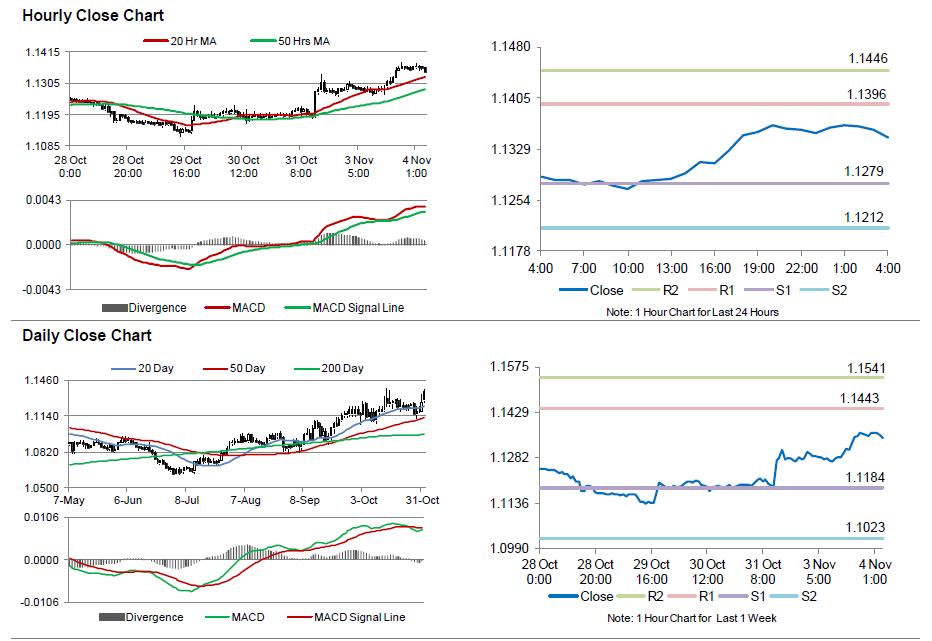

The pair is expected to find support at 1.1279, and a fall through could take it to the next support level of 1.1212. The pair is expected to find its first resistance at 1.1396, and a rise through could take it to the next resistance level of 1.1446.

Trading trends in the CAD today are expected to be determined by the BoC Governor, Stephen Poloz’s speech, scheduled later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.