For the 24 hours to 23:00 GMT, the USD rose 1.06% against the CAD and closed at 1.3162.

The Canadian Dollar lost ground, after data revealed that Canada’s unemployment rate rose to a level of 6.9% in July, in line with market expectations, indicating that the nation is still struggling from economic slowdown. The unemployment rate recorded a level of 6.8% in the prior month. Further, the net number of people employed unexpectedly declined by 31.2K in July, less than market anticipations of an advance of 10.0K and after registering a loss of 0.7K in the previous month. Additionally, the nation’s international merchandise trade deficit expanded to C$3.63 billion in June, following a revised trade deficit of C$3.5 billion in the previous month whereas markets expected the nation to record a merchandise trade deficit of C$2.84 billion. On the other hand, the nation’s seasonally adjusted Ivey PMI rose unexpectedly to a level of 57.0 in July, compared to a level of 51.7 in the prior month while markets expected the index to ease to a level of 50.9.

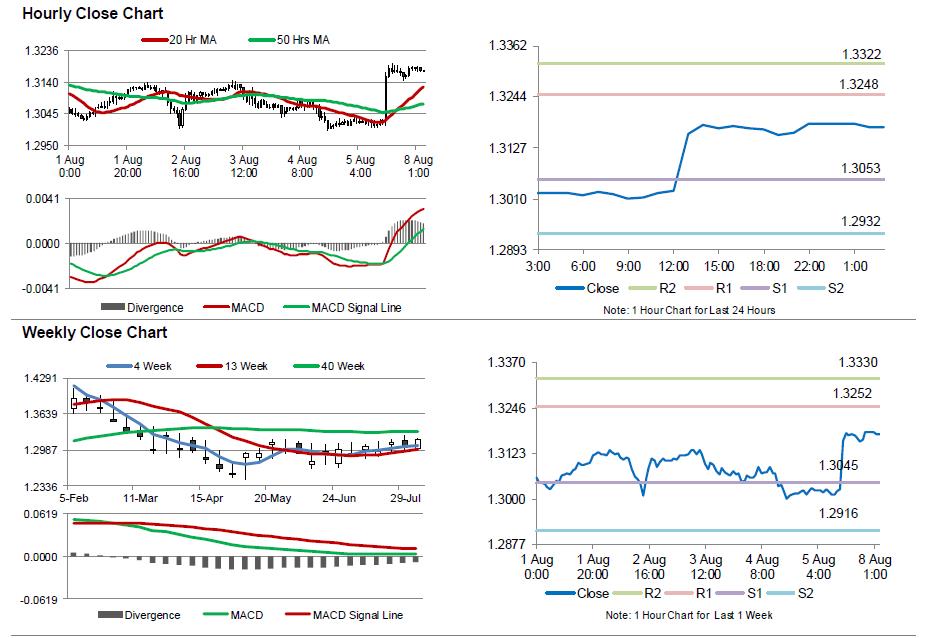

In the Asian session, at GMT0300, the pair is trading at 1.3175, with the USD trading 0.1% higher against the CAD from Friday’s close.

The pair is expected to find support at 1.3053, and a fall through could take it to the next support level of 1.2932. The pair is expected to find its first resistance at 1.3248, and a rise through could take it to the next resistance level of 1.3322.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.