For the 24 hours to 23:00 GMT, the USD declined 0.13% against the CAD to close at 1.2840.

The Canadian dollar gained ground, after Canada’s new housing price index advanced more-than-expected by 0.2% MoM in March, compared to market expectations for an advance of 0.1%. In the prior month, the new housing price index had registered a rise of 0.2%.

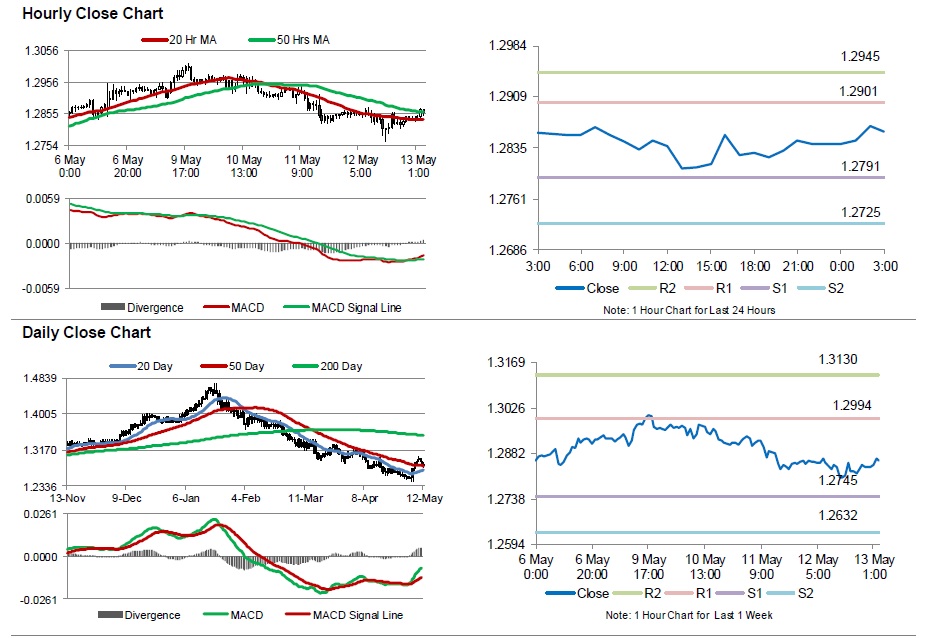

In the Asian session, at GMT0300, the pair is trading at 1.2858, with the USD trading 0.14% higher from yesterday’s close.

The pair is expected to find support at 1.2791, and a fall through could take it to the next support level of 1.2725. The pair is expected to find its first resistance at 1.2901, and a rise through could take it to the next resistance level of 1.2945.

With no economic releases in Canada today, market participants will look forward to the release of the BoC review report, along with the nation’s consumer price index, retail sales and existing home sales data, all due next week.

The currency pair is trading above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.