On Friday, the USD declined 0.21% against the CAD to close at 1.2679.

On the macro front, Canada’s unemployment rate remained unchanged at previous month’s level of 6.8% in June, albeit markets expectations were for it to rise to 6.9%. Meanwhile, the number of employed people in the nation eased by 6.40 K in June, compared to a gain of 58.90 K in May.

In the Asian session, at GMT0300, the pair is trading at 1.2696, with the USD trading 0.14% higher from Friday’s close.

Over the weekend, Canada’s Prime Minister, Stephen Harper, mentioned that the economy of the country is in a downturn, citing the recent slump in the global economy.

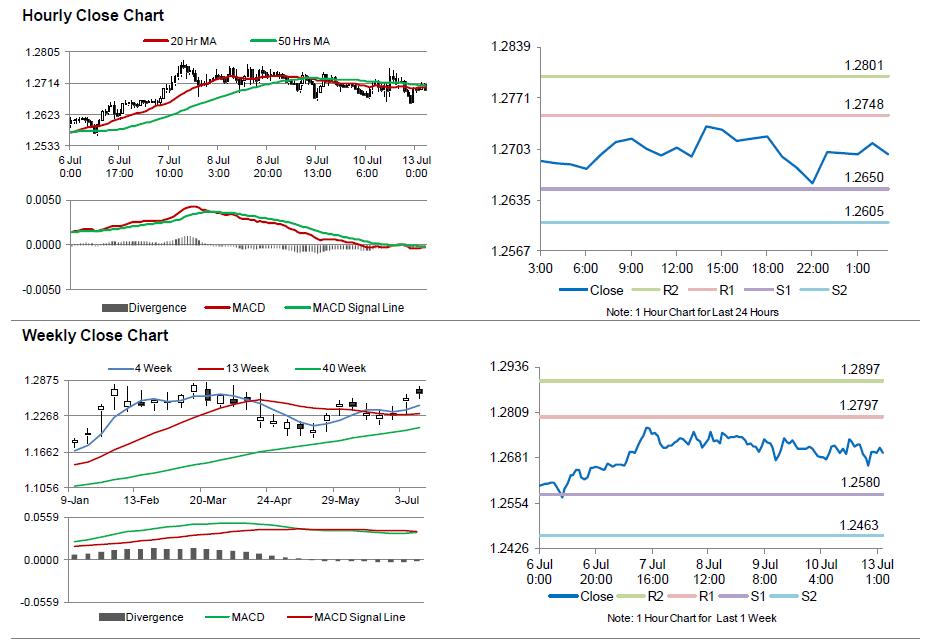

The pair is expected to find support at 1.2650, and a fall through could take it to the next support level of 1.2605. The pair is expected to find its first resistance at 1.2748, and a rise through could take it to the next resistance level of 1.2801.

Amid no economic data in Canada today, investors focused on the BoC’s upcoming interest rate announcement, scheduled on Wednesday.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.