For the 24 hours to 23:00 GMT, the USD rose 0.48% against the CAD to close at 1.1373. The CAD lost ground, after Canada’s new housing price index rose 0.1% on a monthly basis in September, slower than market expected advance of 0.2% and compared to a gain of 0.3% recorded in the prior month.

Yesterday, the Bank of Canada’s Senior Deputy Governor, Carolyn Wilkins stated that the central bank was mulling over the possibility of getting into the electronic money business itself. She further added that the central bank was closely following the risks posed by the new forms of e-money, as it was the bank’s duties to issue currency, promote financial stability and oversee Canada’s payment systems.

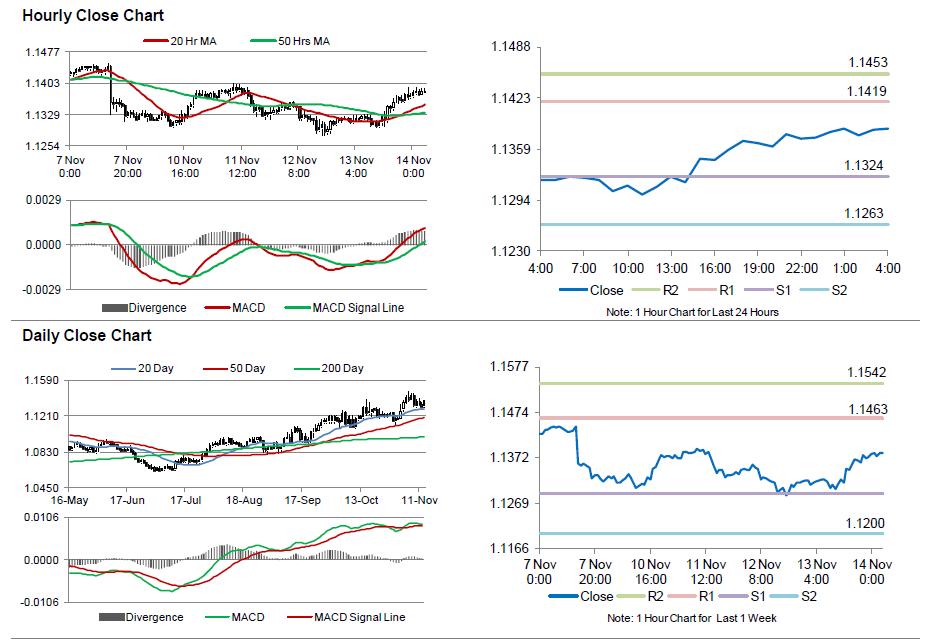

In the Asian session, at GMT0400, the pair is trading at 1.1384, with the USD trading 0.1% higher from yesterday’s close.

The pair is expected to find support at 1.1324, and a fall through could take it to the next support level of 1.1263. The pair is expected to find its first resistance at 1.1419, and a rise through could take it to the next resistance level of 1.1453.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.