For the 24 hours to 23:00 GMT, the USD traded marginally higher against the CAD to close at 1.2315.

On the macro front, existing home sales in Canada was up 3.1% MoM, notching its fourth consecutive month of gains in May, following a rise of 2.3% in the preceding month.

Other economic data showed that manufacturing shipments in the nation slipped more than expected by 2.1% on a monthly basis in April. In the prior month, manufacturing shipments had climbed by a revised 2.70%.

In the Asian session, at GMT0300, the pair is trading at 1.2317, with the USD trading a tad higher from yesterday’s close.

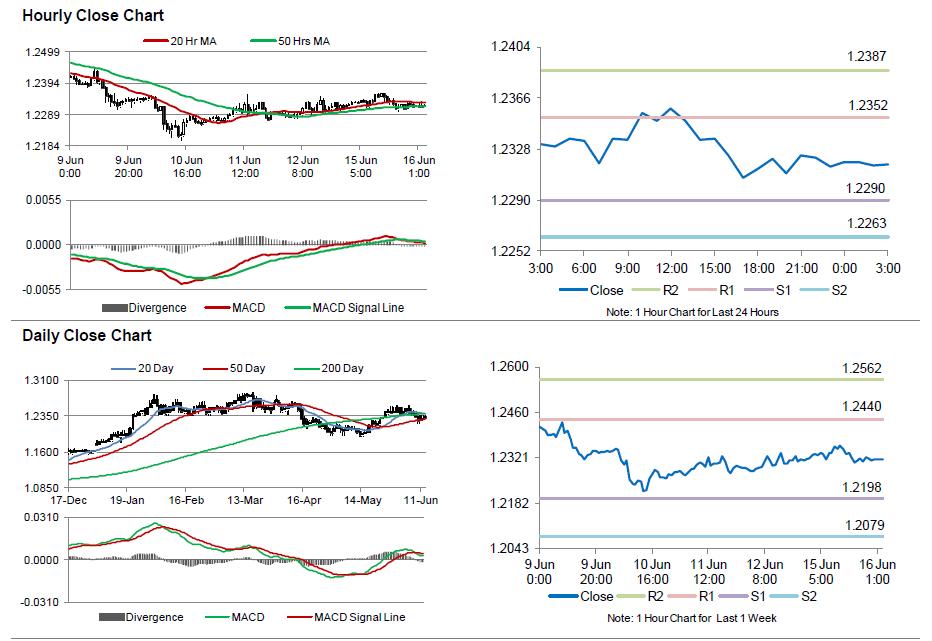

The pair is expected to find support at 1.2290, and a fall through could take it to the next support level of 1.2263. The pair is expected to find its first resistance at 1.2352, and a rise through could take it to the next resistance level of 1.2387.

Amid no major economic releases in Canada ahead in the week, investors would shift their focus to Friday’s consumer prices as well as retail sales data.

The currency pair is trading above its 20 Hr moving average and showing convergence in its 50 Hr moving average.